Bank cards

Locations and opening hours of LHV ATMs can be found on our website and in our mobile app.

All ATMs listed on LHV's website are marked with a corresponding note.

In ATMs with the LHV contactless option, you can also perform operations without having to insert the card into the ATM. The permitted actions depend on whether you tap with a plastic card or with your smart device (e.g. phone or smart watch). In both cases, you need to enter the PIN code of your card.

By taping with a plastic card, you can:

- deposit cash

- withdraw cash

- view account balance

- take a statement of recent transactions

When you tap with a smart device (e.g. if you use a virtual card) you can:

- withdraw cash

- view account balance

Cash withdrawals

It is possible to withdraw up to 1,000 € at a time.

The withdrawal sum also depends on the cash withdrawal limit set for the card. When the limit and balance are sufficient, and it is still not possible to withdraw the sum requested, the reason might be that there are not enough notes in the machine to withdraw the requested amount.

The limitations are imposed by the account owner and/or the user of the card (e.g. account balance or card withdrawal limit). In the case of large amounts there is also a service fee, which can be found in the applicable price list.

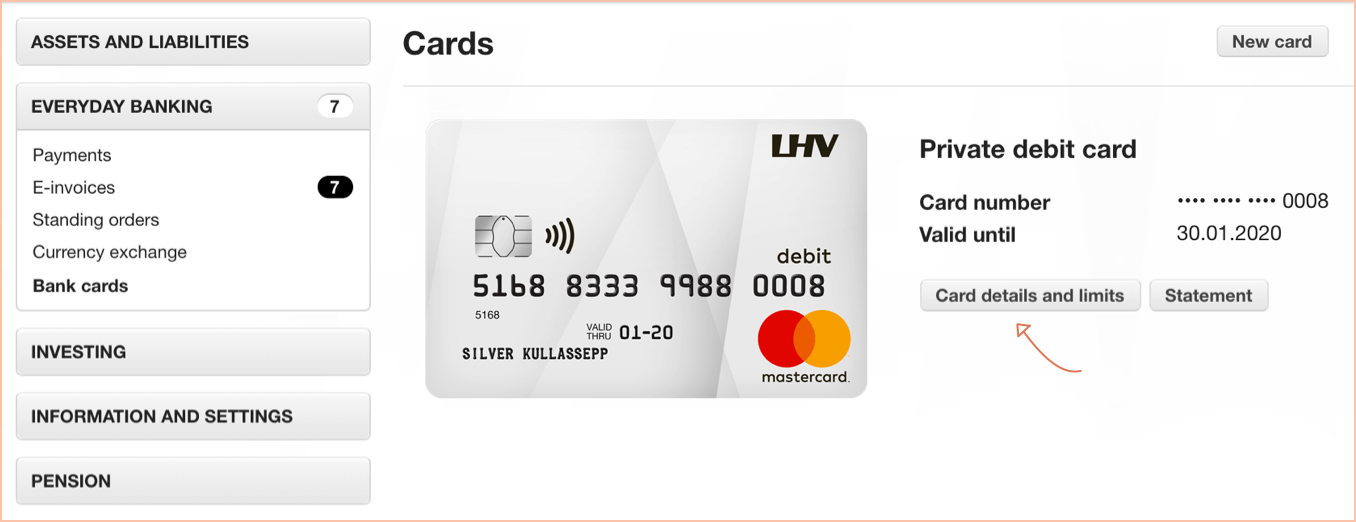

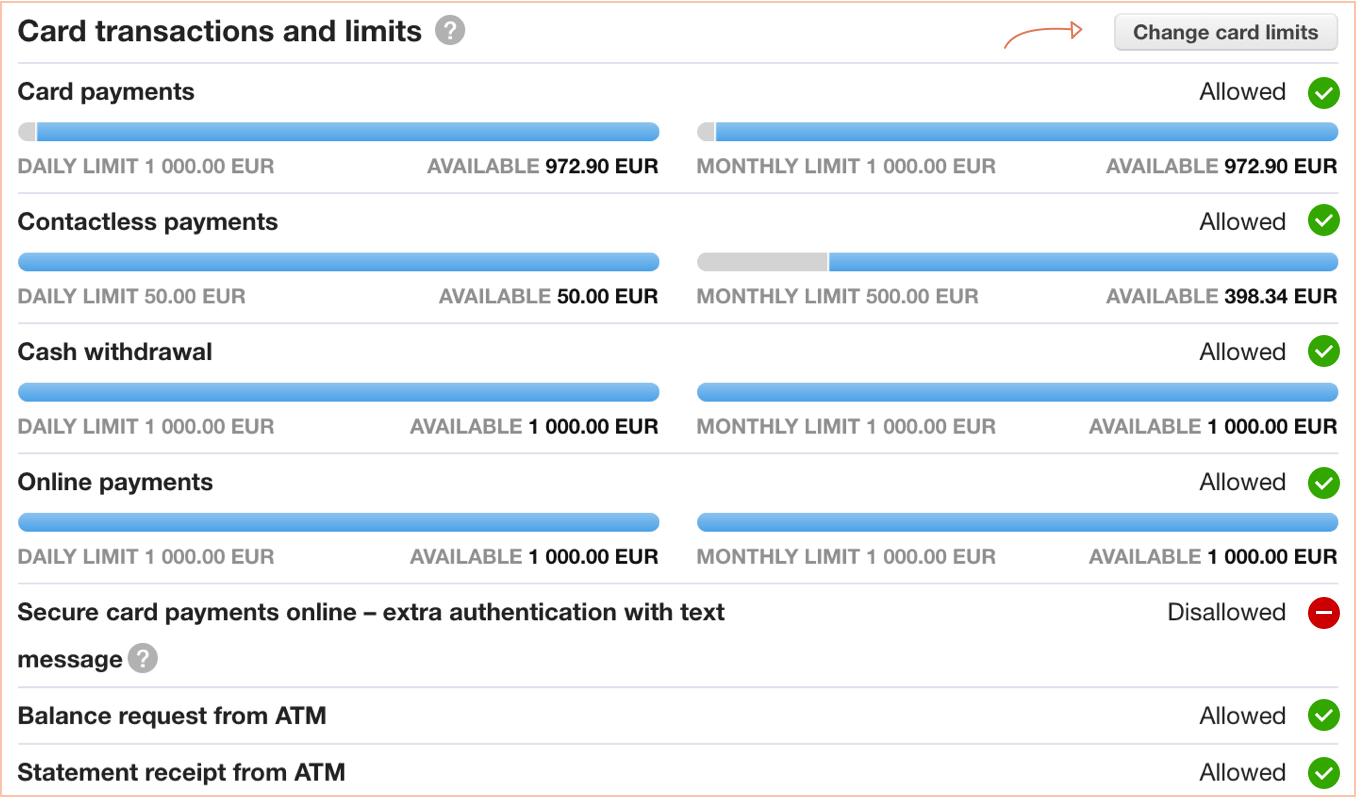

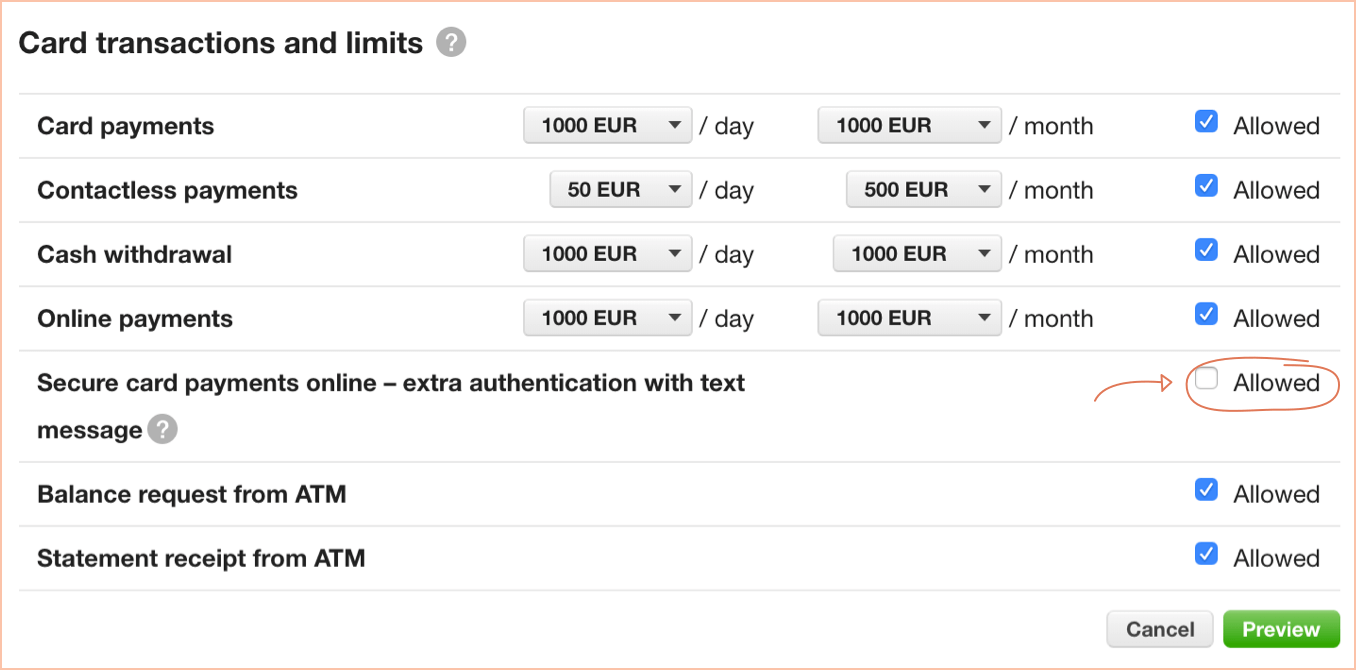

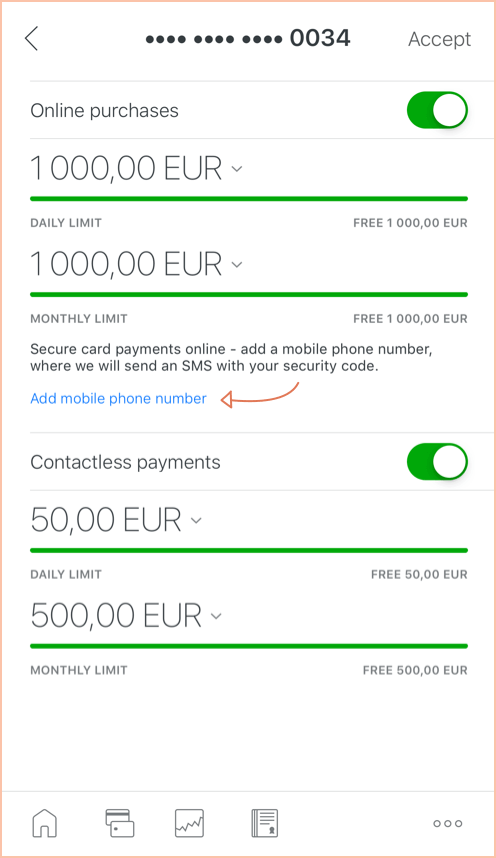

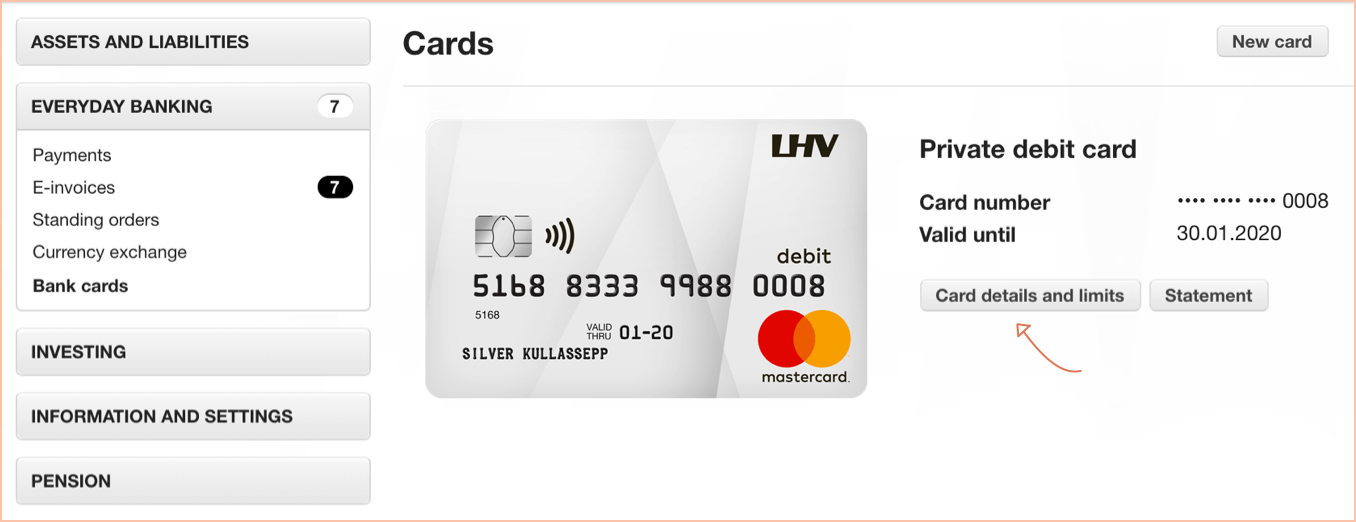

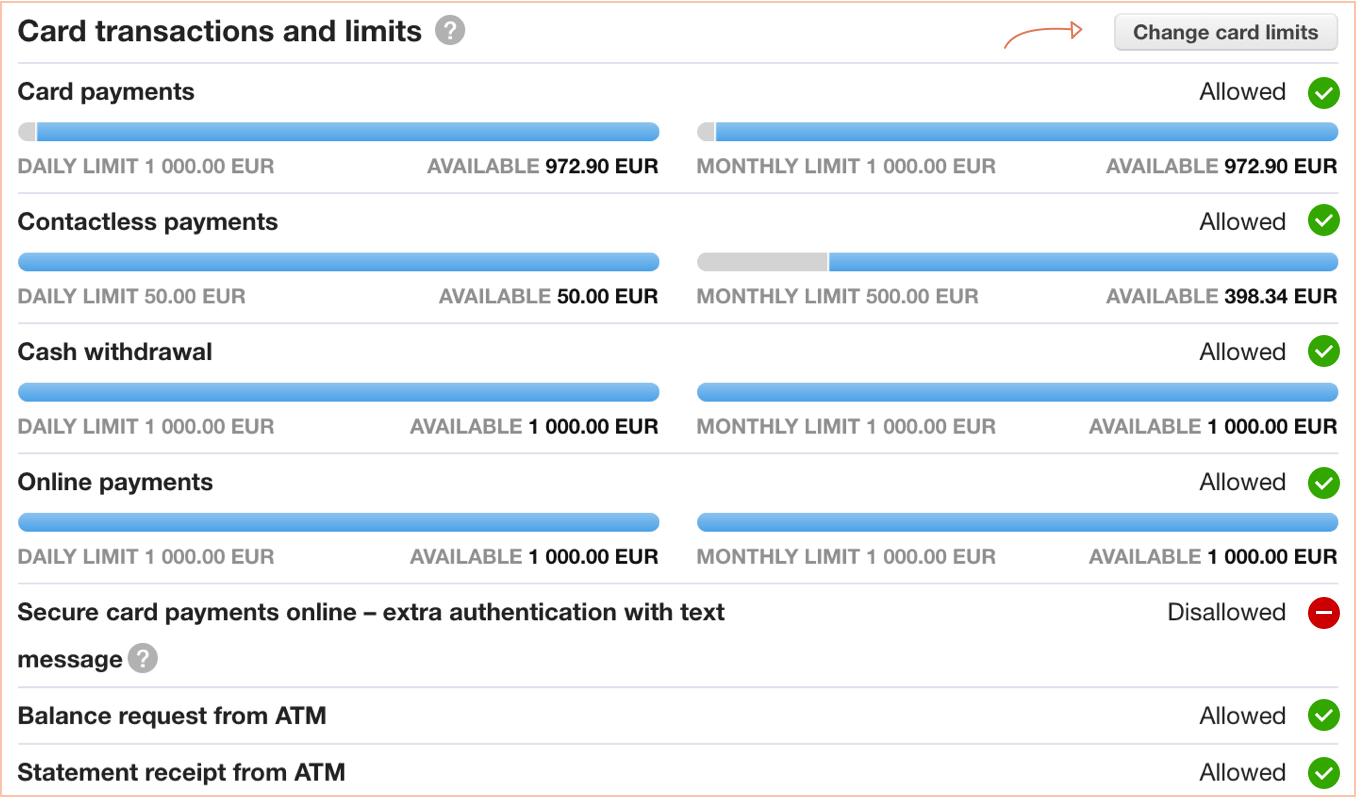

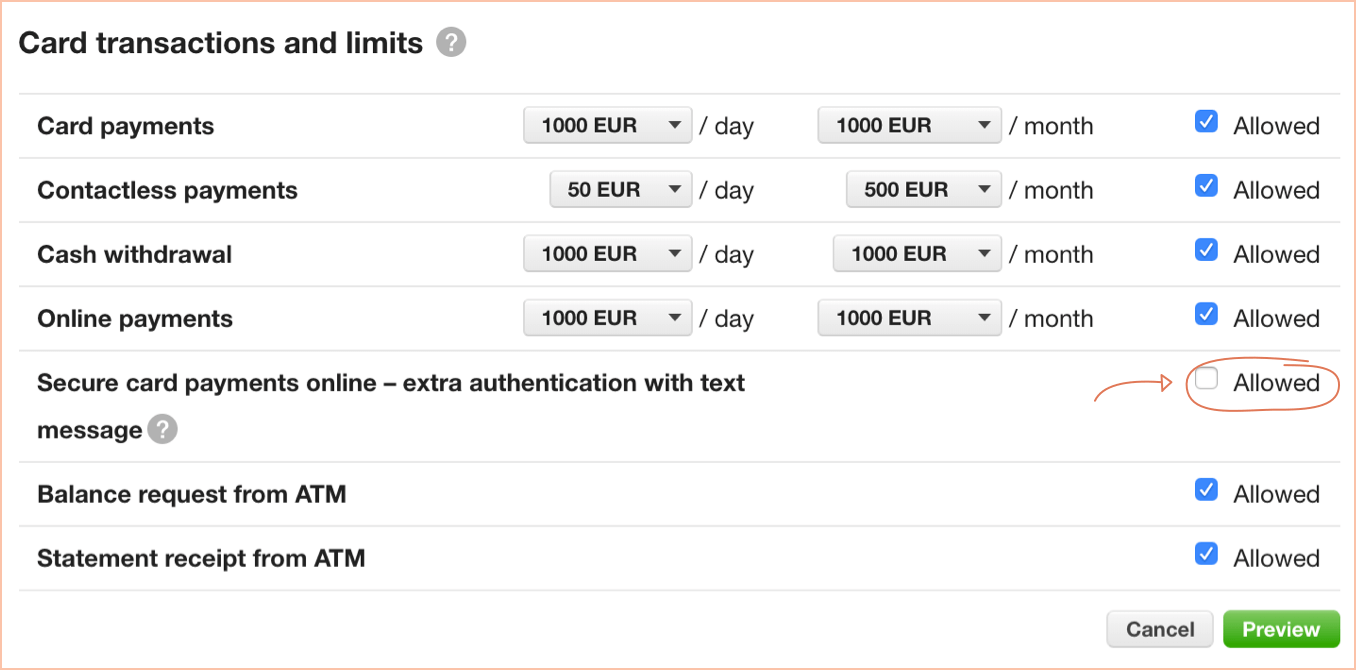

This can be a problem when the account owner and/or the user of the card has placed the respective restriction upon the card. To change the restriction, log in to the internet bank and choose “Everyday banking” ➞ “Bank cards”.

Cash deposits

You can deposit up to 200 banknotes at a time, with no limit on the total amount. However, for large amounts, please be aware of the service fee, which you can find in the current price list.

All euro notes can be deposited, i.e. 5, 10, 20, 50, 100, 200 and 500 euro notes.

No, it is only possible to deposit money into a bank account. Then, if you wish, you can transfer it from your bank account to your credit account.

Other atm operations

The PIN code can be changed for all LHV plastic cards via LHV ATMs. Unfortunately, it is not possible to change the PIN code for virtual cards. If necessary, kindly view the PIN code in the LHV mobile app or internet bank.

General information

Since 2011, two parallel systems have existed in Estonia for the taxation of personal investment income:

- the so-called ordinary system, according to which all transactions involving the sale of securities must be declared, and

- the investment account system, according to which only the contributions to and disbursements from the account must be declared.

Securities income may also be declared according to both systems.

The ordinary system requires the declaration of all securities sales transactions during the year in tax return tables 6.1, 6.4, and 8.2. Income tax is due if the total result of all sales transactions results in a profit. If there is a loss, it can be carried forward to the next year. Realized income can be reduced by transaction fees and management fees paid for holding securities.

Unlike securities, every profitable crypto sale must be declared in tax return table 6.3, but losses from cryptocurrency sales cannot be deducted from profitable sales.

Additionally, all dividends and interest received from Estonian or foreign securities must be declared under the ordinary system. Passive income should be declared in tax return tables 5.1, 7.1, 8.1, and 8.8. Usually, income tax on interest and dividends is withheld at the time of payment, so net income is credited to the account. However, additional income tax liability may arise if:

- A foreign dividend is received without any tax withheld, or

- A foreign interest income is received with a withholding tax rate below 20%.

Securities and cryptocurrency income can be automatically transferred to the tax return (see How is income declared in the ordinary system?).

When using the investment account system it is not the securities transactions that must be declared; instead, the contributions to and disbursements from the bank account marked as the investment account must be declared. An individual may have multiple investment accounts at several different banks simultaneously. A tax liability only arises if the amount by which the disbursements made from all of the investment accounts exceeds the balance of the contributions made to all of the investment accounts.

The tax report showing every contribution to and disbursement from your bank account can be forwarded automatically to the income tax return in the LHV internet bank, from the ‘Investment Account Report’ section.

The main differences between the ordinary system and the investment account system are presented in the following table.

| Ordinary system | Investment account system | |

|---|---|---|

| Selection of assets to be declared | Broader selection | Only financial assets |

| The following must be declared | sales transactions involving securities performed using overall income, all profitable crypto sales, as well as dividend and interest income. If, on the contrary, the consolidated result of the sale of securities over the course of the year is a loss, it is also prudent to include those sales transactions in your income tax return, as in that case you can carry forward the loss amount to subsequent years | contributions to the investment account and disbursements from the investment account |

| A tax liability arises, if | There is an overall profit from securities sales exceeding carried forward losses, a profitable crypto sale occurs, a foreign dividend is received without any tax withheld or a foreign intress is received with less than 20% tax withheld. | |

| Deduction of transaction fees | Allowed | Allowed |

| Deduction of management fees | Allowed | Allowed |

In addition to investing as an individual it is also possible to do so as an enterprise, in which case the taxation of the company’s income resembles the investment account system. However, there are also differences between investing via a private individual’s investment account and investing as an enterprise, the most important of which are related to data disclosure and the deduction of management fees.

If there were no dividend payments or sales transactions in your Growth Account during the year,

- you, as the user of an ordinary system, do not have to report any Growth Account investments at all;

- when using the investment account system, you still have the obligation to report the contributions to and disbursements from the Growth Account, which you can automatically send to the Tax Board from LHV’s internet bank.

Sales transactions and dividends under the ordinary system

If you have received dividends in your Growth Account during the year, you will have to report these in Table 8.1 or Table 8.8 of your income tax return.

If you have also made some sales transactions in your Growth Account during the year, any disposal of fund units must be entered in Table 8.2 of the income tax return.

All necessary data for filling in the tax return can be found in internet bank under “Assets and Liabilities” → “Tax Report”.

Declaration of dividends in the investment account system

The first step is to inform the Tax Board that you are using your Growth Account in the investment account system. To do so, information regarding the bank account being used as the Growth Account must be entered in part I of Table 6.5 of your income tax return.

Only cash contributions and disbursements will be subject to reporting. Information on cash transfers can be found under the internet bank section “Assets and Liabilities” → “Investment Account Report”, which you can send automatically to the Tax Board by pressing the button at the bottom of the page. The forwarded information should be visible in part II of Table 6.5 in the income tax return.

If, during the year, you have received dividends in your Growth Account that are subject to taxation (an overview can be found in the internet bank under “Assets and Liabilities” → “Tax Report”, Table 8.8), you must report these receipts separately in Table 8.8 of the income tax return.

Income tax shall only be paid on deposit interest by those private individuals who are Estonian tax residents and who have not informed LHV Pank that their account, in which the interest is received, is an investment account.

You can inform LHV Pank about the investment account in the internet bank section “Information and Settings” → “Accounts and Limits” → “Accounts”. Select the account and save the selection. Later, you should also declare this account on your Tax and Customs Board income tax return as an investment account.

An Estonian tax resident is a person whose permanent residence is in Estonia or who has stayed in Estonia for at least 183 days in a year. You can check your tax residency in LHV internet bank (“Information and Settings” → “Data”).

You do not have to declare or pay the interest yourself. The bank shall withhold income tax and declare and pay it on your behalf. The data of the interest earned on bank deposits will be automatically shown on your pre-populated income tax return starting from 2019.

A client, whose deposit interest is subject to income tax, will from now on see two entries in their account statement: interest and income tax payment. Calculation of income tax follows the traditional rounding-off rules.

Example

If you conclude a 12-month (365-day) deposit contract in the amount of 500 € with an interest rate of 0.30%, then at the end of the deposit period the bank will transfer the interest to your account in the amount of 1.52 € and withhold 0.33 € as income tax (based on the 22% tax rate applicable from 01.01.2025).

Under the current law, crypto assets are not considered securities, meaning they are taxed under similar rules as other assets (such as real estate or physical gold). This also means that the investment account system cannot be used for trading crypto assets. Read more about the taxation of private crypto assets.

Recent amendments to the Income Tax Act have established a legal basis for classifying crypto assets as securities, but this requires a regulatory license. LHV is in the process of applying for the right to offer crypto asset services that would allow crypto assets to be treated as securities under the ordinary system and, if desired, as financial assets under the investment account system. However, until we obtain this license, crypto asset transaction income must be declared as other income in the ordinary system. We will update this information as soon as we receive the necessary approval.

Standard system

Currently, the only allowed method for declaring crypto assets. Every profitable sale transaction is subject to taxation, and losses cannot be deducted from profitable transactions. For example: if you have sold Bitcoin twice during the year, and you made a profit of EUR 100 on one of the sales and made a loss of EUR 80 on the other, you will have to pay income tax on the entire EUR 100 gain.

You can find information for the declaration of crypto income in Table 6.3 of the LHV tax report. There we will show you all profitable crypto transactions made during the reporting period, grouped by instrument. You must review the transactions and, if everything is correct, submit the report by clicking "Send to the Tax and Customs Board".

Generally, it is sufficient to declare crypto gains on an instrument-by-instrument basis. For data verification purposes, the Estonian Tax and Customs Board may require you to provide a statement of all your crypto transactions. An overview of all transactions, including loss-making ones, can be found in the ‘Assets and liabilities’ → ‘Trade report’ section of the LHV Internet Bank.

Investment account system

As crypto assets do not fall under the definition of financial assets, they are not eligible for the investment account tax benefit. For this reason, it is a good idea to make transactions with crypto assets in another account that you do not use as an investment account.

However, if you have bought and sold crypto assets in your investment account, please do the following:

- In Part II of Table 6.5 of your income tax return, declare purchases of crypto assets as a cash withdrawal from an investment account. If, after the purchase transaction, the total amount withdrawn exceeds the balance of the contributions to the investment account, you will have to pay income tax on the difference. If you sell crypto assets from your investment account, declare the proceeds from the sale as a cash contribution to your investment account. You can automatically transfer the required data on investment account contributions and withdrawals to the Estonian Tax and Customs Board from the ‘Assets and liabilities’ → ‘Investment account report’ section of the LHV Internet Bank.

- If you made at least one profitable crypto sale transaction through your investment account during the year, LHV will automatically submit Table 6.3 (’Transfer of other property’) to the Tax and Customs Board along with Table 6.5. Note that losses from crypto transactions cannot be deducted from profits, meaning income tax must be paid on every profitable transaction. To insert data submitted from the LHV internet bank to you income tax return, log in to the e-MTA portal, open Part II of Table 6.5 and Table 6.3 in your tax return one by one and click ‘Data of the ETCB’ → ‘Replace data’ → ‘Confirm’.

PIA or securities transactions carried out through a PIA do not have to be declared to the Estonian Tax and Customs Board. PIA is treated as a pension fund: contributions are exempt from tax and withdrawals are taxed on the full amount withdrawn.

Tick “Income received in the pension investment account“ in table 5.1 and 7.1. This way the dividends and interest received on the Pension Investment Account will not be calculated as your annual income nor influence the amount of tax-free income.

If you received interest on financial assets acquired via a Pension Investment Account from which income tax has been withhold and the interest has been prefilled in Table 5.1 of the income tax return, then tick the respective line. In that case the withheld income tax will be refunded.

Starting from the income tax return for 2024, which must be submitted between 15.02.2025-30.04.2025, the management fees paid for the safekeeping of securities (including VAT) can be taken into account in order to reduce taxable income.

Declaration depends on:

- the chosen declaration system chosen (i.e. the ordinary system or the investment account system), and

- from which bank account the management fees have been deducted.

See the following table for a more detailed guide on how to declare management fees.

| Securities were acquired in: | Management fees were paid from: | Action required: |

|---|---|---|

| the investment account system | an account declared as an investment account | Management fees no longer have to be declared as a withdrawal from the investment account. In the LHV investment account report, all management fees paid since 01.01.2024 are shown as tax-neutral (i.e. non-reportable) transactions, so you do not have to do anything extra. Check the data and send the report to the Tax and Customs Board. |

| a regular bank account | When compiling an investment account report, the management fees charged from the regular account are indicated as a contribution to the investment account. Example: You have a Growth Account opened at LHV, which you declare annually in Table 6.5 of your income tax return. However, the management fees of the Growth Account are usually paid from your everyday banking account. When you prepare an investment account report for your Growth Account, you will see that the management fees are shown as contributions to the investment account. | |

| the ordinary system | an account declared as an investment account | Management fees no longer have to be declared as a withdrawal from the investment account. In the LHV investment account report, all management fees paid since 01.01.2024 are shown as tax-neutral (i.e. non-reportable) transactions, so you do not have to do anything extra. Check the data and send the report to the Tax and Customs Board. |

| a regular bank account | Management fees paid since 01.01.2024 can be declared as an expense in table 6.1 of the income tax return. LHV's tax report includes an aggregate amount of all management fees that were deducted from your LHV bank accounts in Table 6.1. Check the data and send the report to the Tax and Customs Board. Example: You invest in US stocks through a regular securities account and pay management fees from an everyday banking account. When compiling a tax report for a securities account, we display the following information in the 'TOTAL AMOUNTS' section of table 6.1 of the tax report: Name and ISIN code: LHV safekeeping fees Type and date of transfer: safekeeping fee, 31.12.2024 Quantity: 1 Acquisition cost: total management fee including VAT Costs related to transfer: 0.00 Sales/Market Price: 0.00 |

If, during the year, you have received payments on the shares of your Estonian companies, made at the expense of the reduction of share capital, this data will appear automatically as pre-filled in Table 7.1 and/or column 4 of Table 6.4 of the Estonian Tax and Customs Board's (ETCB) income tax return.

Ordinary system

Taxable income is the difference between the payments declared in column 4 of Table 6.4 and the acquisition cost of shares.

The amount of capital share reduction taxable at the personal level will automatically appear in column 4 of Table 6.4 of the income tax return. In column 3 of the same Table, you must manually enter the acquisition cost (you can find it in LHV's summary statement or, if you have already sold the shares, in LHV’s tax report).

At the same time, it should be borne in mind that the acquisition cost, which has already been deducted on one occasion, cannot be taken into account for the second time. It means that after the share capital has been paid out, the acquisition cost of your shares will be reduced by the amount indicated in column 3 of Table 6.4. When you start selling your shares, you have to take it into account and correct the acquisition cost shown in LHV's tax report before submitting your income tax return, as changes in the acquisition cost due to the reduction of share capital are not reflected in LHV's system automatically.

Investment account system

Since share capital returns credited into an investment account usually constitute tax neutral transactions within the investment account system, make sure that the share capital payment entry in LHV’s investment account report has not been ticked, before submitting the data to the ETCB. In addition, make sure to delete the pre-filled data from Table 6.4 in order to defer the income tax liability arising from the distribution of share capital.

If part of the payment has been taxed at the corporate level, you can declare this portion of the share capital distribution as an investment account contribution in Part II of Table 6.5 of the income tax return. The amount of share capital distribution on which income tax has been withheld at the corporate level is automatically pre-filled in Table 7.1 of the income tax return.

Declaration via the ordinary system

In the LHV internet bank you will find your tax report, which consolidates all of the information in your LHV bank accounts regarding gains or losses from the transfer of Estonian and foreign securities, interest income from securities and dividends from abroad.

Information from the tax report can be used to complete your income tax return.

If you are declaring securities income in both the ordinary system as well as the investment account system, remove the investment account entries from the LHV tax report.

If you have received securities related income from somewhere other than LHV investment services (for example, crowdfunding platforms), then this data must be added to your income tax return by hand.

For declaration under the ordinary system, the Tax Report is available in the LHV internet bank. Its format corresponds to the respective tables of the tax return.

In the LHV internet bank select “Tax Report” from the “Assets and Liabilities” section.

- Check the accuracy of the data in the tax report.

- Submit the declaration by clicking the ’Send to the Tax and Customs Board’ button.

- In the e-Tax Board, accept the data by clicking the ‘Data of the ETCB’ → ‘Replace data’ → ‘Confirm’ button for each applicable tax return table.

If you click on a security's ISIN code in the LHV’s Tax Report, you will get a detailed transaction statement related to the acquisition of that security position – this is the securities transaction report.

This report is useful

- in calculating or controlling the acquisition cost, especially if, following the acquisition, a spilt or other corporate activity (merger, division, etc.) has taken place;

- in the case of a purchase or sales transaction for securities that is the result of the exercising of options. The costs associated with acquiring an option shall be included among the costs of the securities (call option) or the disposal costs (put option).

Any gain or loss that you have received from the sale of shares, investment fund (including money market funds) shares, bonds or debt obligations, options, derivative instruments or other unnamed securities (meaning the sale or in the course of an exchange for the asset) must be shown in the income tax return.

- When selling – the difference between the acquisition cost and the sales price of the security.

- When exchanging – the difference in market price between the acquisition cost of the security that was exchanged and the market price of the security that was received in exchange.

In the case of the merger, division or transformation of companies and non-profit organisations, new holdings received by way of exchange of shares shall be taxed when they are transferred. The difference in the acquisition cost of the exchanged share and the sales price of the share received shall be taxed.

Under similar conditions, the gains received from the transferring of shares acquired through the switching of the investment fund units of European Union Member States are also taxed.

No, you can’t do that, since the acquisition cost of the share is taken into consideration during the taxable period when the share was transferred.

No, you do not. A relevant entry does appear automatically on the tax return; however, since a transfer of securities from one of your accounts to another does not constitute a transfer of securities, you may delete this row from the declaration.

The acquisition cost of a security is comprised of all of the expenses incurred and documentarily certified in the acquisition of that security.

As the costs directly attributable to the disposal of the asset are an indefinite legal concept, they must be viewed separately in the case of each specific transaction. Directly related costs can be costs that are necessary for the transaction, without which the transaction would not be possible to complete.

Account management fees for the securities account or any other overhead costs that have been incurred by the taxpayer are not taken into account as expenses. These costs are to be borne by the individual irrespective of the transfer of the securities and cannot be deducted from the gains or added to the losses.

In this case, the tax liability arises from the transfer of shares. Their acquisition cost is zero.

No, the switching of such units is not subject to income tax. Transactions involving the switching of these units do not have to be declared.

When calculating the gain obtained from the sale of units acquired during a tax exempt swap, the acquisition cost of the units transferred during the course of the switch can be taken into consideration.

In the case of the transfer of units acquired in a tax-free exchange, the time of acquisition of the units shall be deemed to be the time of acquisition of the units transferred during the switch.

- FIFO method – the transfer takes place in the order of purchase, or

- weighted average method – the acquisition cost for one transferred security is calculated by dividing the sum of the acquisition cost of the same class of securities existing at the time of transfer by their number.

Calculation of the acquisition cost may be complicated by corporate actions (split, merger, division, fund issue, spin-off, etc.), exercise, the transfer of securities from one account to another, etc.

After calculating the acquisition cost using the FIFO method, LHV’s base system for tax reports is also able to transfer the acquisition cost for one transaction over to another. This opportunity is applied, for example, when reflecting a split: a negative entry is made in the client’s account to write-off the securities, while a positive entry is made to apply the new securities position. These entries are linked together to pass on the acquisition cost of the negative entry to the positive entry.

At the same time, more complicated transactions (but also, for example, transferring securities from one account to another) may be reflected as so-called free entries, in which case LHV must manually combine those entries with the necessary coefficients. Failure to do so will result in the acquisition cost transfer not being made and incorrect data may appear in the tax report.

Therefore, in the case of free entries and other potentially unsafe transactions, the corresponding lines in the tax report are marked with red and it is recommended that the customer double-checks them. If necessary, contact LHV in order to combine entries or make other corrections.

The transfer of securities shall take into account not only the benefits derived from the transaction but also the transactions carried out at a loss. As such, it is immaterial whether the loss from the transfer of securities was incurred during that taxable period or earlier.

If the loss from the transfer of securities was incurred in previous taxable periods, the loss must already have been declared and it is then carried forward from previous taxable periods.

If the loss from the transfer of securities is greater than the gain received from the transfer of securities during the same period, the amount of loss exceeding the gain may be deducted from the gain received from the transfer of securities during the following taxable periods.

Shares are not transferred or declared invalid during the bankruptcy process, and a loss cannot be declared. In the case of the liquidation of a company or the receipt of liquidation proceeds income tax is charged on the amount in which the liquidation proceeds exceed the acquisition cost of the holding (except the part of the liquidation proceeds which are taxed at the level of the company). The loss incurred may also be declared upon the liquidation of the company.

A loss, which has arisen from the transfer of securities, may not be taken into consideration in the case of a reduction in the gains from the transfer of securities in the event that the loss was

- suffered due to the transfer of the securities at a price which is lower than the market price to a person associated with the taxpayer or

- upon the transfer of securities acquired from a person associated with the taxpayer at a price which is higher than the market price.

Regarding transactions concluded at a loss with associated persons, place an “X” in column 8 of table 6.1 in your income tax return in the event that you acquired a security granting the right to receive a dividend 30 days before the date on which the persons with the right to receive dividends are specified and you transferred

- on the date on which the persons with the right to receive dividends are specified or

- for a period of 30 days after that date.

In the case of the last two transactions concluded at a loss, write an “X” in column 9 of table 6.1 of your income tax return.

In LHV’s tax report these transactions are marked with three stars (***).

Since the loss from the transfer of shares cannot be taken into consideration in the situation described, the option premium, which would increase the loss, also cannot be taken into consideration.

The sale or exchange of a security in the course of a market transaction before the maturity date of the bond is declared as a security transfer. The yield on an existing bond is taxed as interest, even if the interest is the difference between the issue price and the repurchase price (zero-coupon bond) of the bond.

If the employee has received securities from his or her employer, either free of charge or at a preferential price, on which the employer has paid the fringe benefit, income and social tax, or a physical person has received a security as a gift from a legal person for which the legal person has already been charged income tax, then upon the transfer thereof the sum of those securities will be added to their acquisition cost, for which the employer or the legal person has already been charged income tax.

Ask the employer or legal person that granted the security for a free-form certificate, which includes the name and registry code of the legal person that issued the security, the type, amount and cost of the security and the amount of income tax that the legal person has already been charged. As this amount can only be taken into consideration in the event that the legal person has already been charged income tax on the market price of the free of charge or preferentially priced securities, the certificate must show when and in which amount the income and social tax, mandatory funded pension payment and unemployment insurance premium declaration referred to in Annex 4 or 5 is reflected.

The taxpayer is able to take their own cost incurred in acquiring the option’s underlying assets as the acquisition cost and the value of the option taxed as a fringe benefit by the employer, which is listed on the certificate issued by the employer.

If the underlyings to which the option refers are the holding in the employer or a company that belongs to the same group as the employer, the acquisition of the holding that constitutes the underlying assets of the share option is not classified as fringe benefits, if the holding is acquired no earlier than three years as of the granting of the share option. An employee is required to notify the employer of the transfer of the share option. In the case that the underlyings to which the option refers are changed, the specified term shall be calculated as of the granting of the initial option. If the entire holding in the employer or a company that belongs to the same group as the employer is transferred during the term of at least a three-year option contract, and also in the case that an employee is established to have no work ability or in the event of the death of an employee, fringe benefits do not include the acquisition of the holding constituting the underlyings to which the option refers, to the extent that corresponds to the proportion of the time of keeping the option prior to the specified event.

The exemption from income tax does not extend to the income received from the transfer of the option.

Securities which are acquired through succession or as a gift are reflected in LHV’s tax report at an acquisition cost of zero, i.e. as securities that were received for free. Upon transfer, income tax shall be paid on the sales amount.

Securities transferred via a financial intermediary in a foreign country shall be subject to the same rules as securities acquired in Estonia. Expenses made in foreign currency, the sale price of the securities, as well as the taxes withheld must be converted into euros (if the transaction currency is not the euro).

For this, you can use:

- The European Central Bank's daily exchange rate (used in the Tax Report), which was applicable on the day the expense was made, income was received, or tax was withheld;

- The actual bank exchange rate. You can use the bank exchange rate only if you exchanged currency immediately before the purchase transaction or after the sale transaction.

Securities transferred in a foreign state must be indicated in table 8.2 of the income tax return of a natural person, which is completed in the same way as table 6.1.

A transaction for a transfer executed with shares of this type is shown as securities income obtained in a foreign country.

Based on the information received regarding the securities transactions performed through the NASDAQ CSD (formerly the Estonian Central Register of Securities (ECSD)), the tax authority pre-completes table 6.1 in the tax return of a natural person.

As the NASDAQ CSD does not have comprehensive data on all transactions, it is up to the taxpayer to include data that is missing from the table for transactions that have not been performed via the NASDAQ CSD, or which they have performed with a nominee account and not their own personal account.

At the same time, the taxpayer must also update the transaction information submitted by NASDAQ CSD. For example, NASDAQ CSD is unable to provide the tax authority with information on the acquisition cost of transferred securities.

- The symbol and name of the security, for example, “MSFT: Microsoft Corporation“ or “TAL1T: Tallink Grupp” is always marked on the issuer’s field of LHV’s tax report . While there is no requirement to enter a symbol in the guidelines for completing an income tax return, we recommend that you do so in order to clearly identify the security.

- Depending on the type of security, LHV's tax report includes options for stock, fund units, options, futures and bonds. The income tax return includes options such as shares, units, bonds or debt obligations, derivative instruments, other securities, units in investment funds (including money market funds) and options. In the case of futures, we recommend selecting derivative instruments as the type of security.

- When calculating the acquisition cost, the FIFO method is always used in LHV’s tax report. The acquisition cost includes the costs associated with acquiring securities (mostly service fees, but also, for example, the option premium and service fees for option transactions in the case of the exercising of options).

- Costs associated with the transfer of securities shall also be taken into consideration if they increase the transaction loss.

- Costs associated with the transfer also include service fees.

- The ECB’s euro foreign exchange reference rates are used (if necessary) when converting the sums listed in Table 8.2 into euros, based on the acquisition and settlement date for securities.

- The sums are rounded to two decimal places and, if necessary, this is also done with the number of securities (the restriction arises from the income tax return submission environment).

- Data on the short selling of securities is shown in tables 6.1 and 8.2 of LHV's tax report, in the fields "Sales / Market Price" and "Transfer Related Costs" and redemption data in the field "The Acquisition Cost of Transferred Securities" (although short selling occurs before repurchase). In the case of a short sale, asterisks (**) appear in the tax report, in the issuer field, after the name of the security.

- The option premium can be expensed as part of the acquisition cost of a share when the shares acquired with the option are transferred. If the option is not realised (meaning that the option’s underlying assets are not purchased or sold), then the option premium cannot be included in the costs.

- There is no need to declare a free of payment securities transfer within the limits of one person, it may be deleted from the declaration. In the case of a free of payment transaction, the declarations of tax payers having marked the acquisition cost shall be checked, if it has not been indicated in column 8 of Table 6.1 and/or in column 10 of Table 8.2 that the transaction has been made with an associated person. If the declarant marks the acquisition cost as 0 and the transaction is with an associated party, then it will not, for tax purposes, bring any consequences with it. For example, spouses are associated persons and in the event that the acquisition cost is marked, column 8 or 10 must also be completed. The loss from a transaction with relatives (associated persons) cannot be carried forward.

- The ISIN code of the respective security is used as the dividend payer code in the LHV tax report, with the name being presented as marked in the issuer field in tables 6.1 and 8.2: security symbol and name.

- Field “7. The Amount of Income” shows the gross amount of dividends. For example, if in the case of US shares the dividend recipient receives USD 70 and income tax of 30% is withheld, the gross dividend is 70 / (1– 0.3) = USD 100. Based on this example, income is marked as USD 100 in Table 8.8, and withheld income tax 100 – 70 = USD 30.

- Since LHV holds its clients’ securities with several foreign brokers and one broker may withhold income tax on the dividends while another does not, then income tax on the dividends transferred to the client’s account may only have partially been paid. In this case, LHV's tax report share of the dividend is shown in Table 8.1 and the share in Table 8.8.

- The income tax rate for foreign brokers may also differ. If the client’s securities are held with several foreign brokers, the income tax rate may be their weighted average.

- The date for withholding or paying income tax almost always coincides with the date of payment in the LHV tax report.

- Income and withheld or paid income tax is presented in the original currency, which is marked in field “6. Currency Unit”, and is rounded to two decimal places.

Examples of declarations of securities transactions in the ordinary system

The acquisition cost is found using the FIFO method based on the order of purchase.

Example

14.03.2018 100 shares of MSFT were purchased at a price of USD 24.86, the service fee is USD 22.29, T+2 16.03.2018 EUR-USD exchange rate 1.413.

22.03.2018 200 shares of MSFT were purchased at a price of USD 24.50, the service fee is USD 29.53, T+2 25.03.2018 EUR-USD exchange rate 1.4115.

01.11.2018 150 shares of MSFT were sold at a price of USD 28.08, the service fee is USD 27.47, T+2 03.11.2018 EUR-USD exchange rate 1.3773.

Tax report

Acquisition cost = (100 × 24.86 + 22.29) / 1.413 + (50 × 24.50 + 29.53 × 50 / 200) / 1.4115 = EUR 2648.25

Costs associated with transfer = 27.47 / 1.3773 = EUR 19.95

Sales price = 150 × 28.08 / 1.3773 = EUR 3058.16

MSFT: Microsoft Corporation; share; 150; USA; 2648.25; 19.95; 3058.16

In the event of a split, two entries shall be made in the securities account: with the first entry the entire existing security position will be written off, and with the second entry a position increased by the amount of the split coefficient will be added. Example 2: In the case of one split and an existing position of 100 shares, the entries of –100 and +200 shall be made to the securities account.

Mergers, divisions and other similar corporate actions are reflected in a similar manner. For example, in the case of a merger, the old company’s securities are written off and the new ones are added. At the moment of the split, the acquisition cost of the securities being exchanged is evenly distributed between the securities being replaced, and the calculation of the acquisition cost using the FIFO method is thus interrupted (see example).

Example

14.03.2018 100 shares of MSFT were purchased at a price of USD 24.86, the service fee is USD 22.29, T+2 16.03.2018 EUR-USD exchange rate 1.413.

22.03.2018 200 shares of MSFT were purchased at a price of USD 24.50, the service fee is USD 29.53, T+2 26.03.2011 EUR-USD exchange rate 1.4115.

On 05.05.2018 a 2 : 1 split of MSFT takes place –300 MSFT is written off and +600 MSFT is added, the total acquisition cost is (100 × 24.86 + 22.29) / 1.413 + (200 × 24.50 + 29.53) / 1.4115 = EUR 5267.56.

On 07.05.2018 50 shares of MSFT were purchased at a price of USD 13.06, the service fee is USD 16.79, T+2 09.05.2018 EUR-USD exchange rate 1.435701 (Please Note If the quantity was multiplied by the corresponding coefficient during the course of the split, then the price was divided by the same coefficient).

On 01.11.2018 300 shares of MSFT were sold at a price of USD 14.04, the service fee is USD 27.47, T+2 05.11.2018 EUR-USD exchange rate 1.3773.

Tax report

Acquisition cost = 5267.56 × 300 / 600 = EUR 2633.78

Costs associated with transfer = 27.47 / 1.3773 = EUR 19.95

Sales price = 300 × 14.04 / 1.3773 = EUR 3058.16

MSFT: Microsoft Corporation; share; 300; USA; 2633.78; 19.95; 3058.16

On 02.11.2018 the remaining 350 shares of MSFT were sold at a price of USD 14.12, the service fee is USD 29.66, T+2 06.11.2018 EUR-USD exchange rate 1.377274.

Tax report

Acquisition cost = (5267.56 × 300 / 600 + (50 × 13.06 + 16.79) / 1.435701 = EUR 3100.30

Costs associated with transfer = 29.66 / 1.377274 = EUR 21.54

Sales price = 350 × 14.12 / 1.377274 = EUR 3588.25

MSFT: Microsoft Corporation; share; 350; USA; 3100.3; 21.54; 3588.25

In the case of a reverse split, instead of an increase in the number of securities and a decrease in the price, the corresponding quantity of securities is reduced and the price increases. Example 1: In the case of reverse split and an existing position of 100 shares, the entries of –100 and +50 shall be made to the securities account.

A reverse split is reflected in the tax report in a manner similar to that of a standard split. Even so, it is quite likely that in the case of a reverse split a remainder in rounding will occur. Which is why the owner of the securities receives some cash for the residual position instead of securities, and when the division occurs, the sale of the residual position must be declared.

Example

On 14.03.2018 101 shares of MACR were purchased at a price of USD 15.03, the service fee is USD 19.38, T+2 16.03.2018 EUR-USD exchange rate 1.413.

On 05.05.2018 a 1 : 2 reverse split of MACR takes place –101 MACR are written of and +50 shares are added MACR and USD 22.80 in cash resulting from a remainder in rounding for 1 MACR, total acquisition cost (101 × 15.03 + 19.38) / 1.413 = 1088.05 EUR, 05.05.2018 EUR-USD exchange rate 1.4814.

Tax report

Acquisition cost = 1088.05 × 1 / 101 = EUR 10.77

Costs associated with transfer = 0

Sales price = 1 × 22.80 / 1.4814 = EUR 15.39

MACR: Macromedia, Inc.; share; 1; USA; 10.77; 0; 15.39

On 02.11.2018 the remaining 50 shares of MACR were sold at a price of USD 55.28, the service fee is USD 23.12, T+2 06.11.2018 EUR-USD exchange rate 1.377274.

Tax report

Acquisition cost = 1088.05 × 100 / 101 = EUR 1077.28

Costs associated with transfer = 23,12 / 1.377274 = EUR 16.79

Sales price = 50 × 55.28 / 1.377274 = EUR 2006.86

MACR: Macromedia, Inc.; share; 50; USA; 1077.69; 16.79; 2006.86

New shares obtained as a result of a bonus issue shall be entered in the securities account at a price of zero. Stock dividends and bonus shares are also recognised at zero price.

Example

On 05.01.2018 200 shares of WRT1V were purchased at a price of EUR 55.65, the service fee is EUR 44.57, T+2 09.01.2018.

On 08.03.2018 a bonus issue of WRT1V shares takes place, during the course of which one new share is issued for each existing share, a zero price transfer of +200 WRT1V is made to the securities account.

On 25.04.2018 300 shares of WRT1V were purchased at a price of EUR 26.54, the service fee is EUR 35.07, T+2 27.04.2018. Please Note! The share price fell by half as a result of the bonus issue.

Tax report

Acquisition cost = 200 × 55.65 + 44.57 + 100 × 0 = EUR 11,174.57

Costs associated with transfer = EUR 35.07

Sales price = 300 × 26.54 = 7962

WRT1V: Wärtsilä Oyj Abp B; share; 300; 11,174,57; 35.07; 7962

On 10.10.2018 the remaining 100 shares of WRT1V were sold at a price of EUR 19.95, the service fee is EUR 17.17, T+2 12.10.2018.

Tax report

Acquisition cost = 100 × 0 = EUR 0

Costs associated with transfer = EUR 17.17

Sales price = 100 × 19.95 = EUR 1995

WRT1V: Wärtsilä Oyj Abp B; share; 100; 0; 17.17; 1995

As a result of exercising the call option, the purchase transaction for the share serving as the underlying asset is performed at the strike price. In the tax report the acquisition cost of the option is included in the acquisition cost of the shares being purchased.

Example

On 01.08.2018, 4 BMW call option contracts are purchased with an exercise date of 19.08.2018 and an exercise price of EUR 50, the price of the option agreement is EUR 1.9, the service fee is EUR 16 (one agreement includes 100 shares and the price of the option agreement is per one share).

On 02.08.2018, 2 of the same options were sold at the price of EUR 2, the service fee is EUR 8.

Tax report

Acquisition cost = 2 × 100 × 1.9 + 16 × 2 / 4 = EUR 388

Costs associated with transfer = EUR 8

Sales price = 2 × 100 x 2 = EUR 400

CBMWAUG117200: BMW call Aug 2011 72, option, 2, 388, 8, 400

On 17.08.2018 the remaining 2 option agreements were used to acquire 200 BMW shares at a price of EUR 50, the service fee is EUR 35.16, T+2 21.08.2018.

On 19.10.2018 200 BMW shares were sold at the price of EUR 54.20, the service fee is EUR 43.70, T+2 23.10.2018.

Tax report

Acquisition cost = 200 × 50 + 43.7 + 2 × 100 × 1.9 + 16 × 2 / 4 = EUR 10,388

Costs associated with the transfer = EUR 43.70

Sales price = 200 × 54.20 = EUR 10,840

BMW: BMW AG; share; 200; 10,388; 43.70; 10,840

The result of exercising the put option, will be a sales transaction for the underlying share performed at the strike price. In the tax report the acquisition cost of the option is included in the cost of transfer of the shares being sold.

Example

On 23.11.2018, 400 BMW shares are purchased at the price of EUR 47.30, service fee is EUR 70.58, T+2 27.11.2011.

On 23.11.2018, 4 BMW put option agreements with an exercise date of 16.12.2018 and exercise price of EUR 50 were purchased, the price of the option contract is EUR 2.15 and the service fee is EUR 16.

On 14.12.2018, the purchased options are used to sell 400 BMW shares at a sales price of EUR 50, the service fee is EUR 70.32 EUR, T+2 18.12.2018.

Tax report

Acquisition cost = 400 × 47.30 + 70.58 = EUR 18,990.58

Costs associated with the transfer = EUR 70.32 + 4 × 100 × 2.15 + 16 = EUR 946.32

Sales price = 400 × 50 = EUR 20,000

BMW: BMW AG; share; 400; 18,990.58; 946.32; 20,000

Example 1

On 13.05.2018 Tallinna Kaubamaja (TKM1T) pays dividends of EUR 0.28 per share. The list of dividend recipients is confirmed as at 09.05.2018, with the LHV client having 100 shares.

Tax report

Is not declared and is not reflected in LHV’s tax report.

Please Note! The net amount of dividends received by an Estonian legal person is automatically included in the calculation of annual income.

Example 2

On 01.05.2018 Microsoft (MSFT) pays a dividend of USD 0.10 per share. The list of dividend recipients is confirmed as at 20.04.2018, with the LHV client having 300 shares. Income tax of 30% is withheld on the dividends for the 100 shares.

Gross dividend 300 × 0.1 = USD 30, of which income tax of 30% is withheld on USD 10 and with no income tax withheld on USD 20. Deposited in the client’s account is 100 × 0.1 × (1 – 0.3) + 200 × 0.1 = USD 27.

Presented in LHV tax report Table 8.1:

US5949181045, MSFT: Microsoft Corporation; USA; dividend; 01.05.2018, USD; 20.00; 0.00; 01.05.2018

Presented in LHV tax report Table 8.8:

US5949181045, MSFT: Microsoft Corporation; USA; dividend; 01.05.2018, USD; 10.00; 3.00; 01.05.2018

Based on this example, the taxable income is USD 20 and the income tax paid on it is 20 x 0.2 = USD 4 (i.e. EUR 3). On 01.05.2018 the EUR-USD exchange rate was 1.3145.

Example 3

On 25.04.2018 General Electric Co (GE) pays a dividend of USD 0.14 per share. The list of dividend recipients is confirmed as at 23.02.2018, with LHV having 500 shares. Different foreign brokers withhold income tax according to different tax rates.

Gross dividend 500 × 0.14 = USD 70, of which income tax of 15% is withheld on USD 56 and with 30% withheld on USD 14. Deposited in the client’s account is 400 × 0.14 × (1 – 0.15) + 100 × 0.14 = USD 57.40. The income tax rate becomes 18%.

Presented in LHV tax report Table 8.8:

US3696041033; GE: General Electric Co.; USA; dividend; 25.04.2018; USD; 70.00; 12,60; 25.04.2018

Declaration in the investment account system

An investment account is a cash account, the user of which has declared as an investment account with the Tax and Customs Board (income tax return clause 6.5 part I ‘Investment Account and Credit Institution Information’).

The account must be declared once as an investment account: when filing the income tax return for the year in which use of the account began. Afterwards, the investment account declaration must be completed each year, even if no contributions or withdrawals take place.

The investment account can be closed at any time, although doing so may be accompanied by a tax liability.

An investor may have multiple investment accounts. Based on the example of the services of LHV Pank, it may be an LHV account, an LHV Trader Account, Growth Account as well as a portfolio management account.

NB! According to the new Income Tax Act, in addition to bank accounts, certain accounts opened in e-money institutions, payment institutions, and investment firms can also be declared as investment accounts. Read more about which accounts qualify as investment accounts (in Estonian).

Yes, only financial assets which have been defined in §171 of the Income Tax Act may be purchased for the investment account. Simply put, these are securities that are publicly traded or offered in OECD or European Union Member States. These include negotiable securities traded on securities markets or an alternative market (shares, options, futures), publicly offered investment fund units (except for unlicensed small funds), derivatives (where the underlying asset is a financial asset), bank deposits, publicly offered bonds (including AT1 bonds and covered bonds issued by credit institutions), and short-term debt securities.

NB! Under the new tax law amendments, the following instruments are also considered as financial assets:

- Loans and securities or shares acquired through a licensed crowdfunding service provider in the European Economic Area (retroactively from 2024).

- Crypto assets acquired through a licensed crypto service provider in the European Economic Area or directly from a crypto asset issuer (starting from 2025).

- Forex instruments (retroactively from 2024).

Transactions with financial assets are tax-neutral under the investment account system and therefore do not need to be declared.

However, the following are not considered financial assets: second and third-pillar pension fund units, bonds issued without a prospectus, shares in private limited companies and similar securities, real estate, crowdfunding investments and crypto assets acquired through an unlicensed service provider in a contracting state.

The acquisition of non-financial assets from the assets of an investment account is treated as a payment. Money received from the sale of non-financial assets must also be declared as an investment account contribution.

Only all movements of cash, i.e. contributions and disbursements of cash, are declared in the investment account system. The declaration is to be submitted each year, even if no contributions or payments were made during the year.

The investment account report can be forwarded to the Tax and Customs Board the LHV internet bank under ‘Assets and Liabilities’ → ‘Investment Account Report’. The format of this report corresponds to Part II of Table 6.5 in the tax return. After verifying all data, submit it to the Tax and Customs Board by clicking ‘Send to the Tax and Customs Board’.

NB! If you have received foreign dividends or interest on the designated accounts during the reporting period, from which tax has been withheld (Tables 8.1 and 8.8 in the income tax return), or if you have sold crypto assets at a profit from these accounts (Table 6.3), this information will be automatically sent to the Tax and Customs Board along with the investment account report.

The data sent from the internet bank must be accepted in the e-MTA portal by opening the relevant tax return tables (6.5 Part II, 6.3, 8.1, and 8.8) and clicking ‘Data of the ETCB’ → ‘Replace data’ → ‘Confirm’ at the bottom of each table.

Please also bear in mind that if during the year you sold any Estonian securities, this information will reach the Tax and Customs Board automatically and will appear in table 6.1 of your pre-completed tax return declaration. If those securities were originally purchased in the investment account system, you will need to delete these pre-completed entries from table 6.1 before submitting your tax return.

The method of declaration depends on whether you have declared all your LHV accounts that you use for investing as an investment account to the Tax and Customs Board. See the table for the options available to you.

| What accounts do I have? | I only have an investment account | I only have a regular account | I have both an investment account and a regular account |

|---|---|---|---|

| What report do I need to submit? | Submit the Investment Account Report from the LHV Internet Bank to the Tax and Customs Board. In the account filter, select all bank accounts that you use in the investment account system at once. Accept the data in the e-MTA. | Submit the Tax Report from the LHV Internet Bank to the Tax and Customs Board. In the account filter, select all bank accounts at once. Accept the data in the e-MTA. | Determine which accounts you declare in the investment account system. Submit the Investment Account Report to the Tax and Customs Board for these accounts. Accept the data in the e-MTA. Then generate a Tax Report for your regular accounts and submit it to the Tax and Customs Board. Accept the data in the e-MTA. |

| Do I need to manually declare dividends/interest and crypto income? | No. The information moves automatically along with the Investment Account Report. | No. The information moves automatically with the Tax Report. | Yes, if dividends/interest or crypto income was received in the investment account. |

If during the year you sold any Estonian, Latvian or Lithuanian securities, this information will be automatically transferred from the central securities depository to the Estonian Tax and Customs Board.

As this automatic process cannot distinguish whether the sales revenue has been obtained using the ordinary or the investment account system, the pre-filled data in your income tax return will also include transactions with Baltic securities that you have made within your investment account.

Therefore, you will have to erase the sales transactions that pertain to your investment account from tables 6.1 and 8.2 of your income tax return and use table 6.5 to disclose only cash contributions and disbursements in accordance with the taxation principles of the investment account system.

If during the year you have received dividend payments on foreign securities (including Growth account funds), your obligation to declare the dividend income depends on whether the income tax has already been deducted from received dividends or not.

Dividend payouts on which income tax has been withheld at source are reported in the Investment Account Report available in the LHV internet bank as two separate lines: gross amount of the dividend is shown as a contribution into the account and tax withheld is shown as a disbursement from the account. This format is compatible with the format of Part II of Table 6.5 of Tax and Customs Board’s income tax return, and the content of LHV’s Investment Account Report can be forwarded to the Tax and Custom’s Board automatically from the LHV internet bank. When you submit your LHV investment account report via internet bank, we will automatically send Table 8.8 data (‘Income received in a foreign country and exempt from tax in Estonia’) to the Tax and Customs Board along with Table 6.5. Data sent from the internet bank must be accepted in the e-Tax system by opening the respective tax return tables (6.5 Part II and 8.8) one by one and clicking ‘Data of the ETCB’ → ‘Replace data’ → ‘Confirm’ at the bottom of each table.

Dividends received in the investment account on which income tax has not been withheld do not need to be declared in the investment account system. Obligation to declare will arise only when you withdraw received dividends from the investment account, in which case we will also include this disbursement into your LHV’s Investment Account Report.

Example A: income tax on dividends has been withheld

- Investment Account Report shows gross dividends as contributions into the account and tax withheld is recorded as a disbursement from the account.

- You need to manually complete Table 8.8 of the Tax and Customs Board’s income tax return.

Example B: income tax on dividends has not been withheld

- Investment Account Report does not include dividends received. Obligation to declare arises only when you withdraw dividends from the investment account.

- No need to fill out Table 8.1 of the Tax and Customs Board’s income tax return.

If you would like to begin using your daily bank account as an investment account, you will need to begin keeping track of all contributions and disbursements involving the account. For example, the receipt of wages is to be reflected as a contribution to the account and the payment of utilities as a payment.

Which is why it is easier to keep track of contributions and disbursements if you only use an investment account to perform transactions related to financial assets. We recommend opening two accounts at LHV Pank and making all daily payments from one account, with investments made from the other account (which is declared the following year as an investment account).

An investment account can be declared retroactively in your annual income tax return for the previous year (e.g. the account taken into use as an investment account in 2015 could be declared in 2016).

An investment account system is also affordable for inactive investors. In this case we also recommend that you open two accounts: using one to make daily payments and the other to perform securities transactions.

An investor may have several investment accounts in one bank, as well as in different banks. However, please note that the transactions for each account must be reported to the Tax and Customs Board separately.

The Growth Account can also be declared as an investment account. We definitely recommend that you mark it in your income tax return next year.

Yes. In the case of the LHV Trader account, you must carefully follow the definition of a financial asset. In doing so, you can be sure that you are correctly reflecting deposits and withdrawals in the case of transactions.

Yes, short selling with the investment account is permitted.

Taking out a loan is only permitted within a certain limit: the money can be used as collateral for such obligations, which are directly related to the acquisition of the financial assets. Financial assets themselves can be used as collateral or may be pledged. The granting and repayment of margin loans are tax-neutral transactions and do not need to be declared. However, interest paid on the use of a margin loan is considered a withdrawal from the investment account.

ll fees that are not directly related to securities trading and safekeeping must be declared as withdrawals. These include interest payments, Baltic Analyses fees, portfolio management account fees, and all cash withdrawals. Securities purchase and sale transactions made within the investment account do not need to be declared in the tax return.

No, this was only possible in the 2012 income tax return, and no further losses of this type can be declared as a deposit.

Generally, securities cannot be declared as deposits. However, there are only two exceptions to this rule:

- A account opened with an investment firm in a member state of the European Economic Area (EEA) before January 1, 2024, can be declared as an investment account in the individual’s 2024 tax return. For any financial assets purchased through such an account before that date, the acquisition cost of the financial asset can be declared as the 2024 investment account deposit in order to defer the income tax obligation arising from any gains or income.

- In the case of inheritance between spouses, if the inherited financial assets were their joint property, the heir may declare the ‘transferable amount’ from the deceased’s investment account as a deposit in their own tax return. Read more about inheritance of the investment account.

In order to receive interest income from Estonian bonds and holdings without paying income tax, you must notify the issuer of the security or the depositary separately from the investment account. In the case of LHV Group bonds and LHV holdings, this can be done conveniently from the LHV internet bank: “Information and settings” → “Accounts and limits” → “Accounts”. Select the account and save the selection. Later, you also declare this account on your income tax return as an investment account. Other issuers (for example, Inbank, Baltic Horizon) must be notified separately.

Unfortunately, in most cases this is not possible. Income tax on dividend payments is always withheld under the laws of the payer’s country of residence and regardless of whether the investment account system was used for declaration or not. If you have received dividends on which income tax has not be withheld (as may be in case of Latvian stocks or Growth Account holdings), the payment of income tax on dividends can be deferred (see Regarding the declaration of dividends from foreign shares in the investment account system).

On 1 January 2018, the amendment of the Income Tax Act entered into force. On the basis of which it is possible for a company paying regular dividends to utilise a lower tax rate.

At the company level, the income tax rate for regular dividends is 14% (14/86 of the net amount), in the case of other dividends 20% (20/80 of the net amount).

The disbursement of dividends taxed at the rate of 20% is tax free for a private individual. Under the 14/86 rule, dividends payable to a private individual are subject to an income tax of 7% being withheld on disbursements.

For a private individual, both dividend payments are contributions to the investment account. In addition, in the case of a dividend payment subject to a rate of 14%, the amount of income tax withheld at the individual level (7% of the gross amount) will be entered in the investment account statement.

Note! On January 1, 2025, an amendment to the Income Tax Act will come into force, resulting in the dividends of Estonian companies being taxed at a rate of 22% from now on. This means that the current method, where dividends are taxed partially at a 20/80 rate and partially at a 14/86 rate, with an additional 7% income tax for individuals, will no longer apply. The amendment simplifies the taxation of dividends in the future. However, for the year 2024, the previous rules must still be taken into account, so it is important to note that when completing the 2024 income tax return, dividends paid in two parts must still be considered.

No, in the LHV internet bank section “Information and Settings“ → “Accounts and Limits” → “Accounts” designating an account as an investment account only impacts a deposit opened at LHV Pank and the taxation of interest payments on the LHV Group’s subordinated bonds. (see How can the payment of income tax on Estonia interest income be deferred with the aid of the investment account?).

In the case of all types of securities, you will receive reports for use in both systems (investment account and conventional system) from LHV’s internet bank.

You can always leave the securities in your everyday banking account. In this case, they will be subject to ordinary system taxation principles. Alternatively, securities accidentally bought into the everyday banking account can be transferred into the investment account system in three different ways:

Transfer of securities free of payment

This requires the everyday banking account to be declared in the income tax return Table 6.5 from the date of purchase of the securities until the transfer of the securities into the investment account. It may be necessary to reopen previous years' tax returns by the Tax and Customs Board if the securities were purchased in the year before last or earlier. Note: Tax returns older than 3 years cannot be modified! For example, in 2025, only the tax returns for 2024, 2023, and 2022 can be amended.

Associated commissions: Transfer of securities without payment – free for Baltic securities, 3 EUR per position for foreign securities.

Transfer of securities versus payment

This involves transferring additional money into the investment account and making a securities transfer against payment to yourself. The transaction price must equal the acquisition cost of the securities (or be lower).

Associated commissions: Transfer of securities versus payment – 3 EUR for Baltic securities, 25 EUR per position for foreign securities.

Sale of securities from the everyday banking account and simultaneous purchase into the investment account

This involves selling the securities from the everyday banking account, transferring the proceeds to the investment account, and then purchasing the same securities into the investment account. The sale must be declared according to the ordinary system, which may result in a tax obligation if the sale price exceeds the acquisition cost.

Associated commissions: Baltic stocks – free, other securities – two-way transaction fees (for buying and selling) according to the price list. Additionally, consider the possible market price increase between the sale of the securities and the new purchase.

Current taxable income on a financial asset within the meaning of the Income Tax Act (e.g. interest on a bond or deposit) and from the transfer of a financial asset (including the amount received under an insurance contract) must be received in an investment account.

If these sums are received in a non-investment account, then the money must be immediately transferred to an investment account. This means that the money received from the investment many not be placed into consumption before being transferred to the investment account. Immediately means the performance of the obligation as soon as possible, depending on the obligated person.

Income received from a financial asset, which is not immediately transferred to the investment account, is deemed to be a disbursement.

If the company that issued the shares leaves the stock exchange, this is not considered a withdrawal from the investment account, the company's shares will remain as a financial asset in your investment account. However, you have to take into account that in the future you will not be able to sell or buy these shares on the stock exchange. If you manage to find an interested investor, you can initiate a security transaction with the delisted shares via a free-of-payment transfer or a delivery-against-payment transfer. In the case of a sale transaction, the income received may not be declared as a contribution to an investment account. In the case of a purchase transaction, the cash that was paid must be declared as a withdrawal from the investment account.

The Ministry of Finance has prepared investment account instructions.

Declaration of income on behalf of a child

A child’s investment income must be declared in the income tax return, when

- the child’s account has been added to the investment account system;

- securities income (including dividends) from abroad has been received in the child’s account;

- the child’s account contains taxable profit or a loss, which you want to carry forward to the next year;

- the child’s income (for example, Estonian dividends and profit from sale of securities) in exceeds the tax-free income of EUR 7848.

Thus, it is not necessary to declare the child’s investments using the ordinary system in the event that no sales transactions are performed during the year, no money is received from abroad, and the income is below the tax-free income of EUR 7848.

When using an investment account, the child’s account should be declared annually.

On its homepage, the Tax and Customs Board has prepared a precise overview of individuals who must submit an income tax return.

The tax report can only be submitted to the Tax and Customs Board by the parent, who must log into the internet bank and select the child's role. The tax report can be accessed under the section 'Assets and Liabilities' → 'Tax Report'. If everything is correct, submit the report using the "Send to the Tax and Customs Board" button. Then, in the e-Tax portal, accept the data by opening the child's tax return and clicking 'Data of the ETCB' → 'Replace data' → 'Confirm' for each applicable table.

An investment account report can be forwarded to the Tax and Customs Board only by a parent, by logging in to the LHV internet bank and selecting the child’s role.

The investment account report can be forwarded to the Tax and Customs Board from the “Assets and Liabilities” → “Investment Account Report” section of the internet bank. If everything is correct, submit the report by clicking on the button “Saada EMTA-sse”. Then continue completing the income tax return in the e-Tax Board: open Part II of Table 6.5 of your child’s income tax return, press the button ‘Data of the ETCB’ and finally click on ‘Replace data’.

In addition, if during the year your child received dividend payments on foreign securities (including Growth account funds), on which income tax has been withheld, such dividend income must be manually declared in Table 8.8 of the child’s income tax return (see Regarding the declaration of dividends from foreign shares in the investment account system).

If the child has an ID-card, they can submit the income tax return in the e-MTA themselves. If the child does not have an ID-card, then the parent can submit the income tax return on behalf of the child by logging in to his/her own e-MTA and selecting the child’s role.

The Tax and Customs Board has also prepared a set of instructions for declaring income.

E-invoice

An e-invoice is an electronic invoice sent to the Internet bank, replacing a paper invoice. You can order e-invoices from your service provider who provides their clients with such an option.

If you have ordered an e-invoice, we shall prepare a pre-filled payment order according to the e-invoice, which you can review and confirm for payment in LHV Internet bank.

The e-invoice standing order service allows you to pay invoices automatically. You only need to order the e-invoice and set up the automatic payment. The standing order service is convenient because it does not require separate approval of regular invoices.

Concluding an e-invoice standing order agreement and standing payments are free of charge for you at LHV.

You can choose the day on which the e-invoice arrives at the bank as the payment date for the e-invoice, or the payment due date for the e-invoice as established by the company who issued the e-invoice. Some companies provide the possibility to choose a date from their suggested range as the payment date for an e-invoice.

This service is free of charge for LHV clients. We shall not charge you for paying the invoices either.

The easiest way to order an e-invoice is via the Internet bank. To do so, choose Everyday banking → E-invoices → Order new.

You can confirm the pre-filled payment order by clicking „Pay“on your e-invoice post-it note in Internet bank. Upon paying the invoice, it is possible to immediately conclude an e-invoice standing order agreement. The concluded e-invoice standing order agreement shall become valid from the next incoming invoice.

It is possible to conclude an e-invoice standing order agreement immediately when processing the e-invoice order. To do so, in the Internet bank choose Everyday banking → E-invoices → Order new.

If the e-invoice order has been processed, then in the Internet bank choose an e-invoice, for which you want to conclude a standing order agreement, from the menu of e-invoices. To do so, choose Everyday banking → E-invoices → Choose e-invoice → Order details and changing → Invoice payment → Change.

The concluded e-invoice standing order agreement shall become valid from the next incoming invoice.

In the Internet bank choose an e-invoice, for which you want to change the standing order agreement, from the menu of e-invoices: Everyday banking → E-invoices → Choose e-invoice → Order details and changing → Invoice payment → Change.

The changes to the e-invoice standing order agreement shall become valid from the next incoming invoice.

If you terminate an e-invoice standing order agreement but an e-invoice has already come in, then termination does not apply to this invoice and it shall be automatically paid by the bank.

You can cancel the automatic payment. Here you will find an explanation how to do that.

If the issuer of the e-invoice permits the cancelling of the e-invoice order in the bank, then in the Internet bank choose the e-invoice, the order of which you wish to cancel, from the menu of e-invoices. Everyday banking → E-invoices → Choose e-invoice → Order details and changing → Cancel.

If the issuer of the e-invoice does not permit the cancelling of the e-invoice order in the bank, contact the issuer.

If you did not order the e-invoice but only pay it, only the person who has an agreement with the service provider can cancel the e-invoice order.

Please inform the service provider issuing the e-invoice about the problem.

If there are insufficient funds in your account on your chosen payment date for paying the e-invoice, the bank shall try to pay the e-invoice until the payment date shown on the e-invoice.

If there are insufficient funds on the account on the e-invoice payment date, the payment shall not be executed. In this case, you need to pay the invoice manually.

If you have entered an e-invoice standing order agreement for which you have also set a separate limit, the e-invoice was not paid due to the limit being too low.

Check the limit for e-invoice standing order agreements in your Internet bank: Everyday banking → E-invoices → Choose e-invoice → Order details and changing → Invoice payment → Limit.

If you have concluded an e-invoice standing order agreement, then partial payment of the e-invoice is not possible at LHV.

Without an e-invoice standing order agreement partial payment of the e-invoice is possible. When paying in this way, remember that many services shall not be extended before the invoice has been fully paid (e.g. newspaper order, sports club’s monthly pass, insurance agreement, etc.).

You do not have to settle the e-invoice at the bank, since an e-invoice is not an obligation towards the bank. An e-invoice is an obligation towards the company that issued it. If the e-invoice was not paid at the bank, you must ensure that you will not remain in arrears towards the company that issued the e-invoice.

If you have concluded an e-invoice with standing order agreement which is related to the e-invoice, and you wish the bank not to settle the e-invoice automatically this time, you will have to cancel the payment prepared by the bank. You can conveniently do so yourself in the Internet bank: Everyday banking ➞ Payments ➞ Pending Payments ➞ Select the payment you want to cancel ➞ Cancel selected ➞ Cancel payment.

If you have concluded an e-invoice with standing order agreement which is related to the e-invoice and in the future you wish to pay the e-invoices manually, end automatic payment of the e-invoice. You can do this conveniently in your Internet bank: Everyday banking ➞ E-invoices ➞Choose e-invoice ➞ Order details and changing ➞ Invoice payment ➞ Change ➞ Choose “I make my own payments” ➞ Confirm.

Before preparing the e-invoice order at the bank, forward the information of the actual remitter to the company issuing the e-invoice. In the future, the company will send the e-invoice to the actual remitter; however, without a detailed description of the product bought. The company shall send you an e-invoice that you cannot pay, but on which you can see the list of purchased services.

To distinguish between e-invoices ordered from the same company, you can conveniently add an order name to all e-invoices in the Internet bank. For example, you can specify in the name of the e-invoices whether this is your home or car insurance, or life insurance.

You may enter the name of the order immediately when concluding the e-invoice agreement; however, this is not mandatory. The names of orders can be changed or added at any time in the Internet bank.

If the payment date selected in the standing order agreement (for example, the 18th day) is later than the payment due date of the e-invoice (for example the 10th day), your e-invoice will be settled automatically on the payment due date (on the 10th day).