Open an account quickly and easily using the internet bank or mobile app

Your child’s finances

Find the best way to help your child to take their first steps in the money world and invest into their future.

Child Account

Open a free account for your child to let them start managing money matters wisely from an early age.

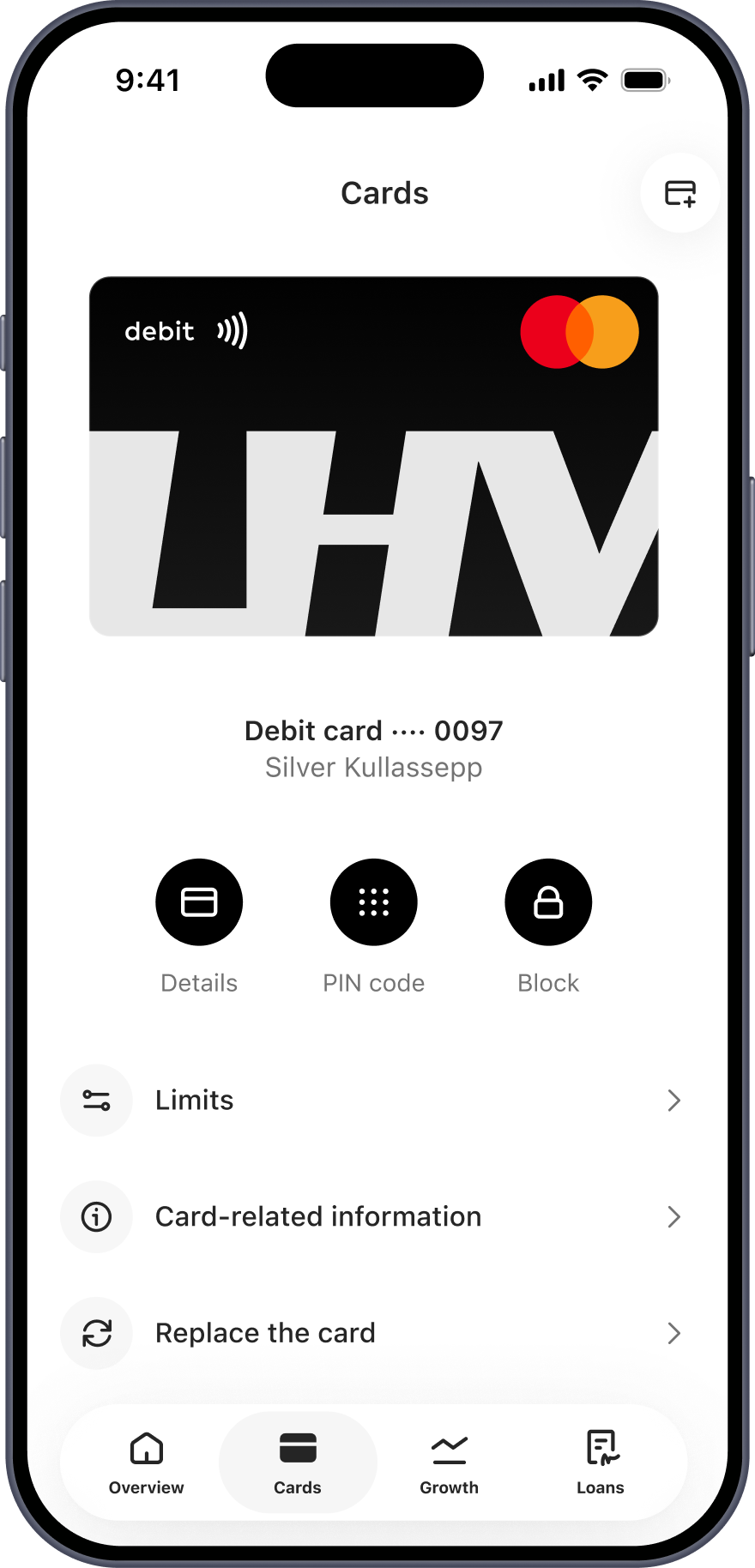

Mobile app

Download an LHV mobile app – a dashboard that shows your child only the essential information about their account.

Child Account

Opening and using the account is free of charge

Use the LHV mobile app to keep an eye on your child’s spending and change bank card limits conveniently

As a parent, you will have an overview of your child’s finances until they turn 18

Steps for opening an account

The Child Account can be opened for up to 17 (incl.) years old child by a parent or guardian with the corresponding right of representation. The child’s ID card, passport or residence permit card issued in Estonia is required for opening an account. If the child under 6 years of age and does not have a valid document, parent’s document is required. If you are not an LHV customer, you can start opening a child account from the homepage.

If you are an LHV customer, log in to the mobile app or internet bank with your username and Smart-ID, mobile ID or ID card.

Go to “Information and settings” → “Agreements” or tap the profile icon in the mobile app and select “Open a new account” → “Child account”.

Conclude the Child Account Agreement.

Change the user role next to your name in the top left corner to start using LHV’s services via the Child Account.

Account access

When the Child Account is opened, only the parent will initially have the right to conclude transactions on the account. From age 7 and up, the parent may grant the child the right to make online payments via the internet bank or mobile app. If you wish to change the limits or rights or to grant the other parent access to the account, please fill out the application on the internet bank in the child’s role, under “Information and settings” → “Accounts and limits”.

To provide the child with a quick and easy view of the account balance via the internet bank or mobile app, the parent can add a login password to the Child Account. To add a password, go to “Information and settings” → “Password management” → “Login password” in the child’s role. Adding a password will allow the child to access the account with his/her personal username and password, granting a limited right of viewing the account balance.

Youth Card

A bank card may be ordered for the child from age 6 and up via the internet bank or mobile app. The card will be sent by post, and will be free of charge for the child until he/she turns 26. We also offer a Youth Card for youngsters, along with a cool contactless payment option and various benefits.

- Free bank card

- Enjoy discounts

- Pay with card and you can win 100 € pocket money and 100 € investing money.

- Your purchases are insured

- Pick your colour

You can order the Youth Card if you are 25 years old or younger.

First steps in investing

Make your child happy with a special treat by giving them a gift card of LHV securities. Investing in your child’s future is a long-lasting and valuable gift.

- Choose a gift card with a design of your choice and add a personal greeting.

- Send the gift card and transfer the appropriate amount to the recipient’s account.

How can I start investing for my child?

In order to start investing on a child’s account, a parent or custodian has to conclude an investment service agreement in the name of the child:

In the internet bank, select the ‘Information and settings’ section in the role of the child.

In that section, click on ‘Agreements’ and then ‘Investment services’.

Conclude an investment service agreement.

If you wish, you can gift your child securities with an awesome LHV securities gift card.

- If you are planning to purchase Baltic securities for your child, then a free Baltic securities account also needs to be opened for him/her.

- If you would like to invest in US stocks, then a W-8 form will also need to be filled in on behalf of the child.

- An easy way to start investing is the Growth Account, where you can invest from as little as one euro if you want.

You can sign all the necessary additional agreements in the ‘Information and Settings’ → ‘Contracts’ section of LHV Internet Bank.

Remember:

- a child’s parents may buy and sell securities on their child’s account only using funds they themselves have transferred to the child’s account. Thus, only the parents can transfer funds to the child’s Growth Account

- funds received from sale of securities must stay in child’s ownership, meaning they may not be withdrawn from child’s bank account without permission from a court

- certain less complex securities (such as shares, bonds, funds) may be given as a gift to the child by persons other than the parents. Remember that in such a case, the parent may sell the securities only after receiving permission from a court. The same applies to inheritance of assets