The most important investment you can make is educating yourself

Taking out a student loan with LHV can help you cover your study-related expenses, from living costs to tuition fees, both in Estonia and abroad.

- We’re accepting loan applications until 29 May

- Interest rate 1.95% + 6-month euribor

- Loan amount up to EUR 6,000 per academic year

- Apply conveniently in the mobile app

- One guarantor required to apply

- There is no contract fee

- Flexible repayment opportunity

- Transfer your existing student loan to LHV

Calculate the monthly instalment

The result is approximate and may differ from the terms and conditions offered to you. *Check the latest 6-month euribor.

Applying for a student loan without visiting a bank

Application

Fill in a student loan application online or in the mobile app. You can apply free of charge and it does not oblige you to sign a contract.Guarantor application

Your chosen guarantor will complete the guarantor application.Loan decision

We will do our best to inform you of the loan decision within 3 working days.Contracts

We will digitally sign a loan contract with you and a guarantor contract with the guarantor.Done

We transfer the student loan to your account.

Transfer your

student loan to LHV

You can only have a valid student loan contract with one bank. If you have already taken out a student loan from another bank, you can transfer it to LHV. The balance of the current student loan can be transferred under the new loan terms and conditions.

Fill in a student loan application.

Our specialist will inform you of the loan decision. You can also agree on the details of the student loan contract and the guarantor contract with them.

After concluding a new student loan contract with LHV, you will have to pay interest to the previous bank, which is calculated until the new student loan contract is concluded. The exact amount will be communicated to you by your current bank.

LHV will then transfer an amount equal to the balance of your student loan to your LHV account. This amount will be immediately transferred to your current student loan provider to repay your student loan there.

Now your previous student loan has been repaid in full to the current bank. From now on, you will only need to communicate with LHV about student loans.

Applying for a student loan without visiting a bank

| Loan amount | During the 2025/2026 academic year, the maximum amount of the state secured student loan is EUR 6,000. If your nominal period of study is less than nine months, you can take out a student loan of up to EUR 3,000. |

| Loan period | You start repaying the principal of your student loan no later than 12–18 months after graduation, unless you have moved on to further studies during that time. We will prepare the repayment schedule for a period that is equivalent to twice the nominal period of study. If you terminate your studies, the student loan is to be repaid over a period that is one and a half times the length of time spent studying in the educational institution. |

| Interest rate | 1.95% + 6-month euribor. Interest begins to accrue immediately after the loan amount is disbursed and stops when the loan amount is fully repaid. |

| Conclusion of the agreement | Free of charge. |

| Security | Surety from one individual or a property located in Estonia. |

| Grace period | You may suspend repayment of the principal amount of the student loan for the period in which you are on parental leave (for a period of up to three years after the birth of the child), in conscript service, or serving your residency. All student loan interest during that period is paid to the bank by the state. |

| Applicant requirements |

|

| Requirements for the guarantor | The guarantor may be a person who is a citizen of the Republic of Estonia or who is living here based on the right of permanent residence or a long-term residency permit. They must be at least 18 years old and their regular verifiable net income for the last three months must be greater than the minimum wage. The guarantor must fill out a guarantor application sent to their personal e-mail address. Through the link on this application, they can also submit their account statement. |

| Additional documents | We ask for students studying abroad to please send a certificate from their educational institution. If the security for the loan is property, please submit a valuation report and insurance policy for it. The bank reserves the right to request additional documents and supplementary information for making a loan decision. |

The student loan is offered by AS LHV Pank. Always think through your loan decision carefully. Review the terms and conditions at lhv.ee/oppelaen and ask for advice from our specialist. The annual percentage rate of charge is 5.127% under the following example terms: the loan amount is EUR 6,000, the interest is 6-month Euribor + 1.95% per annum (maximum 5% in total), contract fee EUR 0, the loan period is 112 months, of which the first 40 months fall under a grace period for the principal. The total amount to be repaid is EUR 7,946.55, with payment taking place in the form of monthly annuity payments. If property serves as the security for the student loan, an insurance contract on the security must be concluded in order to receive the loan. The rate does not include the expenses related to establishing and insuring the security.

Conclusion of contract

- The Agreement can be concluded from 1 Septemeber to 31 May.

- We will transfer the student loan to your bank account starting on 15 September.

- You may not receive a student loan while you are on academic leave. You may also not apply for a student loan after the fact, i.e. for an academic year that has already ended.

- If you are studying outside of Estonia, please send a certificate from your foreign educational institution to oppelaen@lhv.ee. Make sure that the certificate contains your details:

- name and personal identification code or date of birth;

- your faculty or speciality;

- whether you are studying full-time or part-time;

- level of studies (vocational training on the basis of secondary school, bachelor’s, master’s or doctoral studies);

- beginning and expected end of studies (nominal period of study);

- ISCED (International Standard Classification of Education) level code.

If the certificate is not in Estonian, English or Russian, LHV has the right to request its certified translation (i.e. sworn translation).

- You do not have to be a client of LHV Pank to apply for the loan.

- If you do not have an account with us yet, then now is your last chance to open one, since the student loan will be deposited in your account at LHV Pank. We will also deduct interest and principal payments from this account in the future.

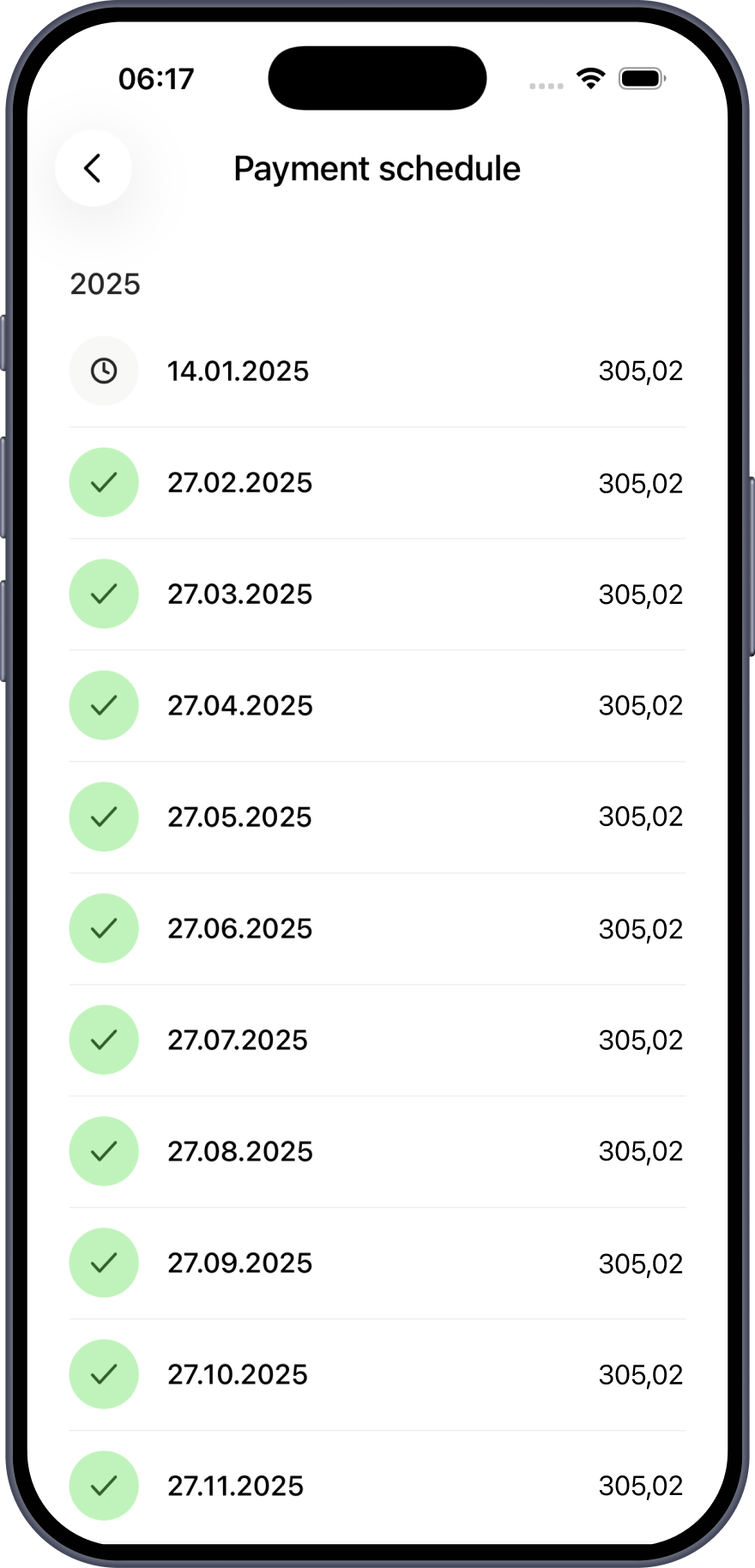

- You can see the loan payment to be made via your Internet Bank and mobile app.

Amendment of contract

- The Agreement may be amended without charge. If you would like to change your repayment schedule, terminate the agreement or make some other changes, please let us know at the address oppelaen@lhv.ee.

- If you terminate your studies, you must repay the student loan in a period that equals one and a half times the length of time you spent studying in the educational institution, but not shorter than 6 months.

- You will normally have to start repaying the principal of the student loan after one year from the date of graduation due to full completion of the curriculum or for any other reason, unless you resume your studies before the end of the year. After graduation, you will start to pay the principal and interest on the basis of a schedule drawn up by the bank, which you will see via the Internet Bank and mobile app. If your studies are interrupted for any reason, you will have to repay the loan within one and a half semesters of study at the educational institution, but not less than six months and not more than one and a half semesters of the nominal duration of the curriculum.

Useful links

Read more about the student loan here:

Customer support

Call 699 9118 Mon-Fri 9–17 or write to oppelaen@lhv.ee