Flexible leasing for both private and business clients

If you wish to purchase a car, motorcycle, recreational craft, or even upgrade your company equipment and heavy machinery, LHV leasing will help you.

- Fast response to the application

- Convenient insurance solution

- Personal client manager

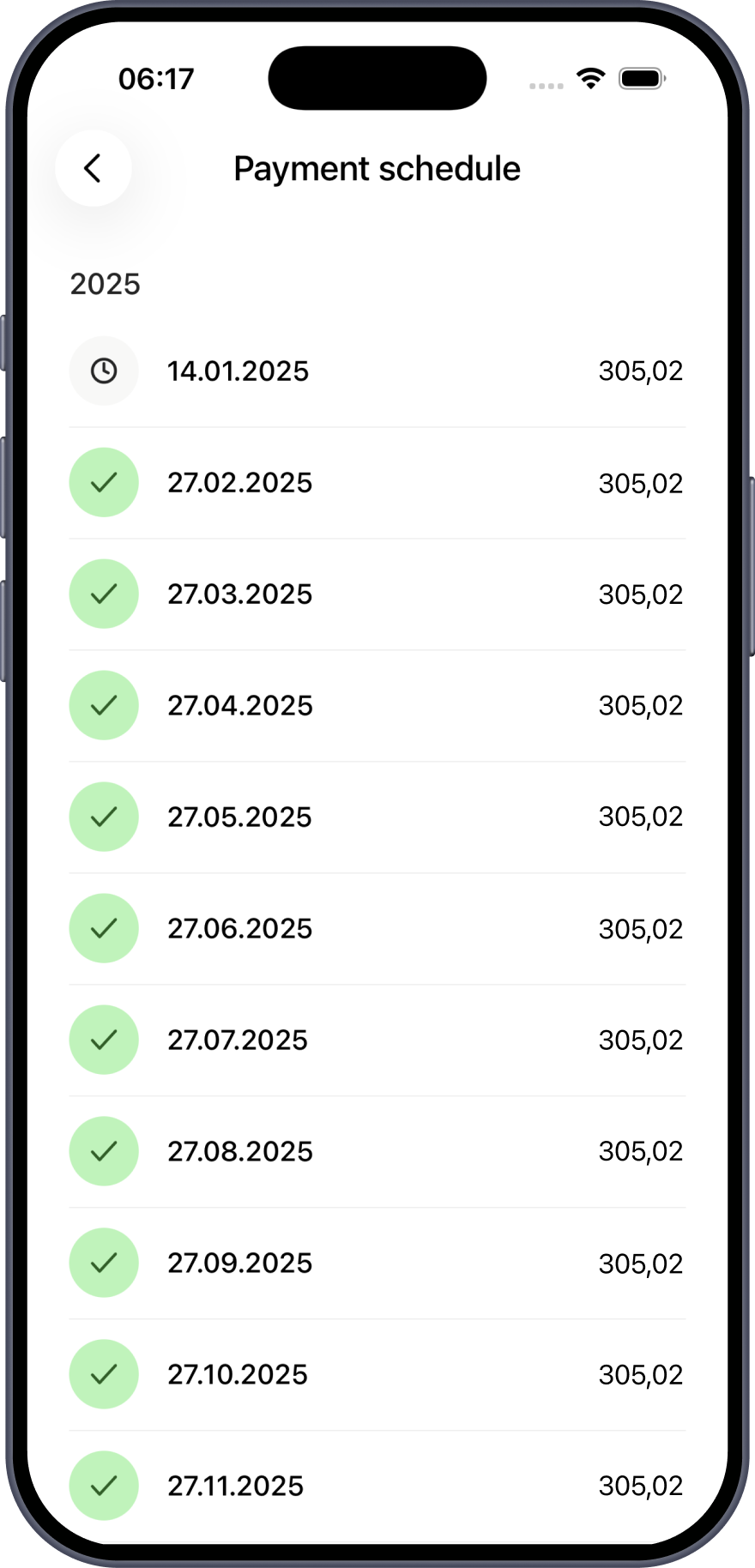

- Simple self-service in the mobile app and internet bank

Interest rate of 1.49% + 6-month Euribor on purchases of electric vehicles

The offer applies to individuals and companies for fully electric vehicles up to two years old, purchased for normal use, and with a cost of up to 60,000 euros, plus VAT.

Calculate the monthly instalment

This is an estimate and may differ from the actual terms and conditions offered.

This is an estimate and may differ from the actual terms and conditions offered.

Application process

Complete an application

Complete the leasing application online or via mobile app.Submit documents

In case you did not provide your account statement nor asset sales advertisement link with submittion of application, please send your bank accounts digitally verified statements for the last 6 months and an asset sales offer to liising@lhv.ee. If you have a bank account only in LHV, the account statement is not required.Offer

We will then make you a personal leasing and insurance offer.Conclude the agreement

If the offer suits you, we will agree on subsequent action for you to receive your new purchase as quickly and easily as possible. Upon purchasing used assets, a valuation report from a cooperation partner of LHV shall be submitted before the conclusion of the agreement. In order to sign the agreement digitally, your identity must have been previously established by the bank.

Complete an application

Complete the leasing application online or via mobile app.Submit documents

Send your client executive or liising@lhv.ee the financial reports verified by a Member of the Board (the most recent, no more than 3 months’ old) and the sales offer for the assets. The sales offer can also be replaced by a reference to a notice of sale added to the application.Offer

We will then make you a personal leasing and insurance offer.Conclude the agreement

If the offer suits you, we will agree on subsequent action for you to receive your new purchase as quickly and easily as possible. Upon purchasing used assets, a valuation report from a cooperation partner of LHV shall be submitted before the conclusion of the agreement. In order to sign the agreement digitally, the identity of the company’s representative must have been previously established by the bank.

Price list and terms and conditions

| Asset purchase price | From 7,500 € |

| Minimum financed amount | 5,000 € |

| Limit on the age of the asset | Not more than 14 years at the end of the leasing period |

| Leasing period | 6 months to 7 years |

| Down-payment | At least 10% of the price of the asset |

| Contract Fee | 1% of the cost of the assets, minimum 150 € |

| Amendment of agreement | Amendment of agreement 100 €. Changing the payment date 30 € |

| Premature termination of the agreement |

|

| Interest rate | The interest rate is personal for each agreement and tied to the six months’ euribor. A personal offer will be made to you after you have completed a leasing application. |

| Applicant requirements | Net income for private person at least € 1000 per month |

| Compilers of the valuation report | LHV Pank accepts valuation reports from the following providers: ValueExpert OÜ, OÜ Roheline Laine, Autotest OÜ, Aktronte Grupp OÜ, Autowelt Baltic OÜ, Tehase Auto OÜ, OÜ Import Auto, and official car brand dealerships. |

Always consider your leasing decision carefully. Review the terms and conditions and ask for advice from our specialist. The Annual Percentage Rate of Charge of the leasing is 8,02% on the following sample conditions: value of the assets 15,000 €, down payment 10%, credit amount 13,500 €, annual interest rate 7% (without fixed rate, based on 6-month’s euribor), contract fee 150 €, leasing period 36 months, total payment sum 16 656,26 €, type of the contract is financial lease, with monthly annuity payments. Insurance payments, registration fee or state fees have not been accounted in the rate. A motor third party liability insurance contract and Casco insurance contract need to be concluded. The funding provided benefits from financing provided by the European Investment Fund under its group risk enhancement mandate with the European Investment Bank in respect of contributing to lending capabilities of smaller institutions and improving financing conditions to small and medium sized companies.

Insurance

In addition to the mandatory motor third-party liability insurance, a leased vehicle must have comprehensive insurance covering the main risks of damage to and destruction of the vehicle. For instance, comprehensive insurance usually covers damage to your vehicle even if you caused the accident.

Leased property that does not participate in traffic must be insured with property insurance.

With Casco insurance, we offer the best insurance cover with the most choices, guaranteeing safety and convenience. There is a separate package for low-emission vehicles – ePremium Casco.

| Standard | Premium | ePremium | |

|---|---|---|---|

| Road accident | |||

| Other accident | |||

| Vandalism | |||

| Theft | |||

| Fire | |||

| Hail | |||

| Windshield breakage | |||

| Collision with an animal | |||

| Roadside assistance cover | |||

| Leasing value cover We ensure the purchase value of the vehicle 6 months after its purchase |

- | 50,000 € | 50,000 € |

| Leasing payment cover We indemnify up to 6 months and up to 6,000 euros your leasing payments |

- | 6,000 € | 6,000 € |

| Trailer cover | - | 1,500 € | |

| Replacement vehicle cover | - | 30 päeva | |

| Technical failure cover | - | 150,000 km | |

| Vehicle replacement cost In case of total loss of the vehicle, its replacement or substitution costs will be added |

5% | 10% | 10% |

| Pet cover | - | 2,000 € | |

| Charging station cover | - | - | 2,000 € |

| Tire cover Extra set of tires, kept in a closed and locked storage, are covered |

500 € | 1,000 € | 1,000 € |

| Travel interruption cover If due to claim event you are not able proceed your travel, then reasonable expenses caused by travel interruption will be indemnified |

1,000 € | 2,000 € | 2,000 € |

| Rental car cover While travelling and not using your own vehicle, we will indemnify the claims arising to rental vehicle used by you |

- | 20,000 € | 20,000 € |

Motor third party liability insurance

- The insurance contract must be concluded for a year.

Casco insurance

- AS LHV Pank must be the beneficiary in the insurance contract.

- The insurance contract must be concluded for a year.

- The insured value of the vehicle must be the market value of the vehicle at the time of concluding the insurance contract.

- The insurance contract must cover at least the following insured risks: traffic accident, natural disaster, fire, theft, robbery and vandalism.

- The insurance cover must be valid at least in the whole of Europe, except the CIS countries.

Please make sure to review the requirements for the insurance of leased property provided in the leasing agreement.

What should you know before concluding a leasing agreement?

Here you will find information of the basic rights and obligations arising from the agreement. This also includes important information about the potential dangers related to leasing. Please read it through.

Please note, that only those rights, obligations, risks and hazards that are the most important and usually create the most questions are listed here. It is also important to remember that this does not constitute your leasing agreement, which may include different terms and conditions.

Before signing the leasing agreement

- Review all the risks related to the lease and consider once more, whether you really want to conclude the agreement. If you are certain in your decision, consider whether financial lease or operational lease is better suited to your needs and options. With financial lease, you will become the owner of the leased property after the payment of all the instalments, while with operational lease, you must return it to the bank. If agreed upon with the bank, it is possible to purchase the leased property for its residual value at the end of the leasing period.

- Please read all the terms and conditions of the leasing agreement, including the general terms and conditions. Also read the Standard European Consumer Information (even if it takes time, this is useful information).

- Please review other terms and conditions and documents referred to in the leasing agreement, like the general terms and conditions of AS LHV Pank (hereinafter LHV).

- Please think about what would happen if your income decreased and expenses increased for some reason. Would you still be able to pay the leasing instalments?

If necessary, consult LHV or another specialist to get explanations, advice or additional information.

Contents of a leasing agreement

As stated above, there are two options for concluding a leasing agreement. Regardless of the type of the agreement, LHV will purchase the item from the vendor and will place it at your disposal. In turn, you will pay the leasing payments until the time specified in the leasing agreement. You will also pay interest.

The amount of the payments depends on a number of different circumstances, such as the cost of the item LHV purchased for you, the sum you contributed yourself, the interest rate, the length of the leasing period, etc. The payments are also influenced by the general economic situation, on which the base rate depends.

If you have signed the leasing agreement, but wish to withdraw from it for any reason, you have the right to do so within 14 days after its signing. To withdraw from the contract, file an application in the manner and to the address provided in the agreement. Additional details on this are provided in the section “Expiry and premature termination of the agreement”.

Interest rate of the leasing

The leasing interest is accounted according to the sum to be paid to the bank, the leasing period and the currently applicable interest rate. This will be done on the assumption that there are 30 days in each month and 360 days in each year. In the first month of the agreement, the interest will be accounted based on the number of days still left in the month after the conclusion of the agreement.

Each time that a subsequent leasing payment is made, the outstanding balance is reduced along with the interest. The monthly payment, however, will remain the same, as you will be able to pay more of the principal on the account of the interest. It will be more convenient for you, as when the payment stays the same throughout the whole period, you do not need to keep up with the schedule constantly. And it also means that the leasing sum will be paid back sooner.

When the base rate changes or an interest period changes, the bank will calculate the monthly payment for the next period again and will notify you of it. What neither you nor the bank can control is euribor, meaning that its fluctuations will also increase or decrease your payments.

The term “the annual percentage rate of charge” is always relevant in case of various loan agreements. It shows the actual final cost of the loan. LHV takes the following into account when determining the annual percentage rate of charge:

- the sum you loan from the bank for the purchase or the credit sum,

- interest,

- agreement fee,

- insurance payments (if you conclude an insurance contract through LHV).

The annual percentage rate of charge is a good indicator in assessing the different offers. When making a comparison, it is important to keep in mind what costs are accounted for in the annual percentage rate of charge, as different leasing providers have different practices.

Violation of payment obligations and the consequences thereof

Make sure that the payments are made on time and in the agreed sum. Failure to pay not only postpones the fulfilment of your obligation, but also involves additional expenses, like a fine for delay and overdue notice fee.

- Fine for delay

If you fail to pay the leasing payment on time, you must pay a fine for delay on the unpaid sum. The exact rate of the fine for delay is provided in your agreement. The late fee is accounted on the principal payment and considered to be paid when you have made the full payment. - Overdue notice fee

If you delay the payment, you will be sent an overdue notice, for which you need to pay separately. The exact fee for the overdue notice is provided in your agreement. - Contractual penalty

If you violate your obligations − for example, failing to return the property to the bank by the agreed time − the bank shall have the right to collect a contractual penalty from you. More information on this is available in the section “Liability and contractual penalty”.

Please remember that if you repeatedly fail to pay the leasing payments, the bank has the right to terminate the agreement made with you, demand the return of the item leased and payment of the debt in full. The payment will include the outstanding principal, any interest, late fees, overdue notice fees and insurance fees paid on your behalf.

If you fail to comply with the payment obligations, the bank has the right of foreclosure. If the funds received do not cover your debt, the item is not bought or you do not return it, the bank has the right to start bankruptcy proceedings. This may include a claim for the sale of other property belonging to you with the aim of acquiring the funds to pay for the object leased.

If you foresee difficulties in making the payments, we ask that you to contact us as soon as possible and without hesitation. Please make sure to do so if the described situation may be permanent, as you lost your job or your salary was cut. Together we will find a solution that satisfies us both.

Other information

Pre-contractual information (incl. terms and conditions) is provided and the agreement concluded in Estonian. The legislation of the Republic of Estonia will be applied to the settlement of disputes. Court proceedings are resolved according to the legally provided jurisdiction and if negotiations with us fail, you have the right to turn to the Consumer Protection Board.

LHV leasing client support

Documents and additional information

Terms and conditions and additional information

- General Conditions of AS LHV Pank

- General terms and conditions of financial lease for private persons

- General operational lease terms and conditions for a private person

- General terms and conditions of financial lease for business clients

- General terms and conditions of operational lease for business clients

- Pre-contractual information

- Guarantor reminder

Frequently asked questions

- What can I lease?

- Do I have to become a customer of LHV to conclude a lease agreement?

- Before I choose a car, I wish to know whether I qualify for a lease and the terms of the lease. How should I proceed?

- What should I do, if my income proves insufficient for qualifying for a lease?

- Should I opt for a financial lease or an operational lease?