Access to the most popular crypto assets

Buy popular crypto assets from LHV. We support many different crypto assets, including Bitcoin and Ethereum.

LHV no longer supports Internet Explorer on our website to better protect you against viruses, scams and other threats. You can still use our website using Internet Explorer, but keep in mind that not everything might work as expected. To log in, please use one of these free browsers: Chrome, Firefox or Edge.

Crypto assets are a digital form of money, which has proven to be a popular complement to “real” money. Crypto assets can be used on different platforms to pay for services or simply as a store of value in the given crypto instrument.

Platforms based on crypto assets are generally structured without a central owner – they remain stable due to their decentralized customer base. For now, crypto assets acquired by clients by LHV cannot be used on platforms to pay for services or make transfers. The best known decentralized crypto asset is currently Bitcoin.

Buy popular crypto assets from LHV. We support many different crypto assets, including Bitcoin and Ethereum.

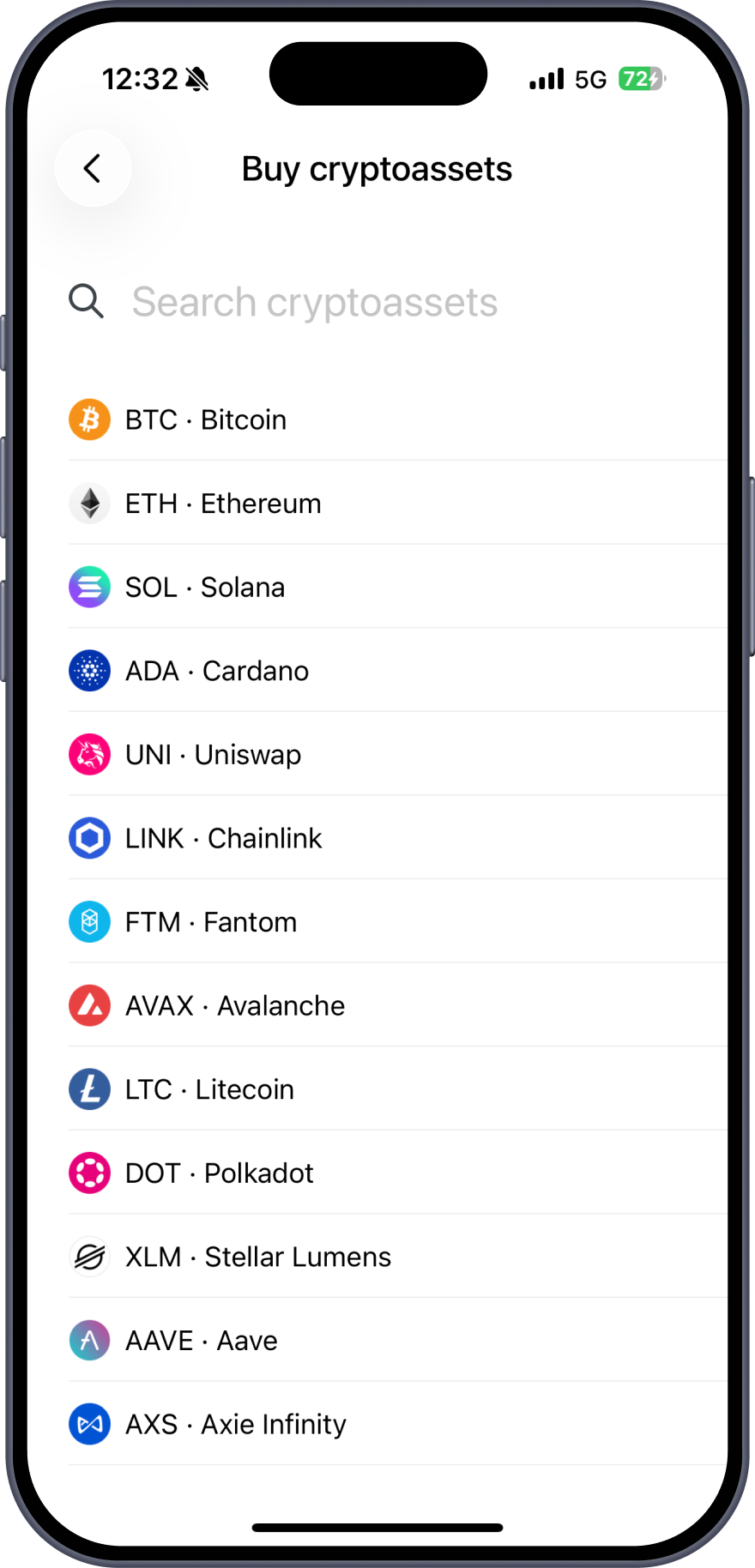

You can buy LHV-supported crypto assets in the mobile app under “Growth”. Tap “+” → “Buy cryptoassets”. In the Internet bank you can buy crypto assets by going to “Investing”, and clicking on “Crypto assets buy/sell”

You can trade crypto assets any time and day of the week. Transactions are executed immediately.

Buying and selling small amounts of crypto assets is cost-effective. While transaction fees on larger platforms can be up to 10% of the transaction amount, LHV’s transaction fee is 0.5% regardless of the amount.

See the price list.

You can also buy crypto assets in fractions of units. The minimum buy order is 20 euros and minimum sell order is 10 euros.

For individual investors who have acquired crypto assets, income tax returns are easy, because we display your capital gains by each instrument. You no longer have to report each transaction to the tax office separately. Instead, you can declare your gains for each instrument.

Read more about taxation of crypto transactions.

Buy popular crypto assets from LHV

Bitcoin is a digital decentralized virtual currency. Bitcoin uses a type of distributed ledger technology, where all computers on the network are involved in record-keeping. The fact that the addresses of the computers are not personalized enables the same kind of anonymity that is associated with cash.

Ether is the currency used on the Ethereum platform, and can be used to pay for various services and perform transactions on the platform. Ethereum is a decentralized blockchain platform, on which various applications can be built. It is a specific type of cryptocurrency that keeps a wide network running. But Ethereum is also a tradable crypto asset.

Litecoin is an open-source code blockchain, often referred to as Bitcoin’s little brother. Litecoin is similar to Bitcoin precisely in that it is also considered a digital currency and payment system that can also be used for payment. The speed of Litecoin transaction processing is four times faster than Bitcoin’s and a larger amount of Litecoin can be mined.

Uniswap is one of the most popular decentralized crypto exchange protocols running on the Ethereum blockchain. The Uniswap platform allows you to exchange one crypto asset for another.

Chainlink is a decentralized virtual currency linked to smart contracts built on the Ethereum platform. The Chainlink service allows data from the outside world, such as stock prices, to be linked to Ethereum’s smart contracts and the contracts can be automatically applied.

Stellar is a crypto asset that aims to serve as a cross-border payment system for any asset (shares, crypto assets, euros, etc.). It is a payment system designed for consumer use.

Polygoni aims to increase the number and speed of transactions on the Ethereum platform while reducing the cost of those transactions.

The Aave protocol matches up two parties: lender and the borrower. The lender earns interest on the loans and the borrower can take out a fixed interest loan in the selected crypto asset. Aave runs on the Ethereum network using smart contract technology.

Axie Infinity is a virtual game of a new generation, where all of the players can own the game and vote for the direction of the future developments. The players can earn crypto assets (Axie Infinity Shards, AXS) for playing, and spend them at the marketplace of the game by buying virtual assets to use in the game, or vote for the direction of platforms development.

Cardano is a “third-generation” decentralized blockhain platform that allows to code smart contracts into blockchain which should be more environmentally sustainable and higher in efficiency than Ethereum blockchain. ADA is the native cryptocurrency of Cardano that can be used on the platform to buy services and make payments.

Sandbox is a virtual world, where players can create and own virtual assets (NFTs) and earn virtual assets from their gameplay. Sand token, built on Ethereum blockchain, is used as the currency for the ecosystem and can be used for paying for platform’s services, trading on the virtual marketplace and also for voting on the direction of the platform development.

Fantom is a “new-generation” decentralized blockchain platform that supports smart contracts. The platform’s unique technology aims to reach high scalability, high security, and high decentralization simultaneously, in order to provide the best base infrastructure for building DeFi applications. FTM is the native cryptocurrency that can be used on the platform to participate in blockchain operations, voting, and transaction fees.

Avalanche is an open-source high-speed decentralized blockchain platform that can complete transactions in less than a second. Thanks to Proof-of-Stake’s validation method and its unique architecture, one of the key features of Avalanche is its low energy consumption which allows keeping the “gas charges” in the blockchain low. The platform supports a full suite of tools used in Ethereum’s network and also allows users and businesses to create their own financial assets and DeFi applications.

Solana is one of the best known blockchains, that supports smart contracts. Solana uses proof of stake transaction validation process, which is highly energy efficient. Technologically, the key aims of the blockchain are fast and cheap transaction processing. SOL is platform’s native cryptocurrency that can be used to pay for transactions fees on the network and to validate transactions (staking).

Polkadot is a blockchain protocol that aims to unite various blockchains (e.g. ethereum and bitcoin networks) into interoperable decentralized network. Polkadot promises flexible, secure and scalable transfer of data between various blockchains, bringing closer the future of decentralized networks, without major reliance on a single blockchain. DOT is platform’s native cryptocurrency that can be used to pay for transaction fees, to validate transactions (staking) and to vote on the future direction of the blockchain.

Open the LHV mobile app and go to the “Growth” view.

Tap “+” → “Buy cryptoassets”.

Fill in the appropriateness questionnaire and accept the terms of service for the crypto transaction.

Select the desired crypto asset from the search, specify the amount you want to buy, and click “Buy”.

The crypto assets will show up on your account immediately.

Log into LHV Internet bank and go to „Investing“ and click on „Crypto asset buy/sell“.

Select the account where you’d like to purchase the crypto assets to. Find the suitable crypto asset and insert the sum you wish to buy for.

Agree with the terms of service for the crypto transactions.

The crypto assets will show up on your account immediately.

If you’re trading crypto assets as an individual, bear in mind that any transaction that nets gains should be reported to the tax authorities and is subject to income tax. Note: Gains are not offset by losses. So, for example, if you have a capital gain of €20 from selling Bitcoin and make a loss of €30 later on, you still have to pay income tax on the €20 gain.

We have made it as easy as possible to declare the income from crypto assets to the tax authority. When it comes time to file you taxes, you will receive a summary of your crypto asset transactions via LHV internet bank, which you can submit to the Tax Board more easily: by each instrument. As an individual, you won’t have to report each transaction to the tax office separately, but you can submit the summary to the tax office, prepared by us for each instrument.

Read about the taxation of crypto assets for private persons.

We’ve made it easy for business clients to buy crypto assets: you don’t have to spend time opening an account with another crypto trading site. A company also does not need an LEI code (link) to buy crypto assets. If you have a corporate account with LHV, you can also buy crypto assets there. Gains from crypto assets are taxed in the same way as any other corporate income: the tax liability only arises if the company pays dividends, salaries or fringe benefits.

| Maximum order amount | 100,000 € |

| Transaction fee (buy-sell) | 0,5% |

| Management fee | Free |

| Minimum buy order | 20 € |

| Minimum sell order | 10 € |