The ending year has been very difficult on the world’s securities markets. Geopolitical tensions have been high, and the US–China trade war and their struggle for dominance in the world economy have worsened the global economic environment.

Although price growth has slowed markedly in recent years, it is still too early to declare a final victory over the inflation spectre. This limits central banks’ ability to support the economy through monetary policy if necessary.

LHV pension funds have coped fairly well in this tense environment — and not because we tried to pick individual winners. We do not think that all pension assets should be placed in stock markets, nor do we believe that taking more risk always leads to better results.

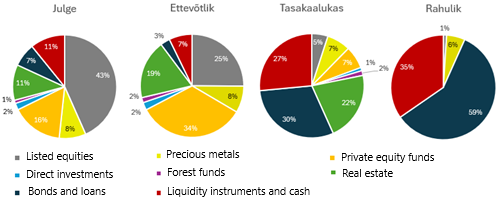

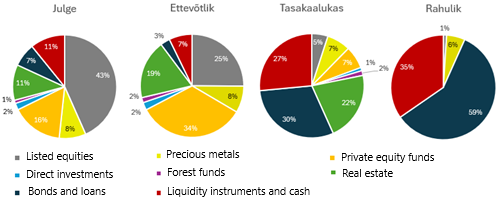

Diversification goes beyond the two basic asset classes

In addition to exchange-traded stocks and bonds, LHV pension funds also invest in companies that are not publicly listed. We usually invest in such companies through private equity and venture capital funds, and sometimes directly together with the funds in which we are investors.

In Estonia, we also compete with banks by financing small and medium-sized Estonian enterprises: we organise their bond issues and participate in issues arranged by others.

We invest in real estate in several ways as well. The LHV pension funds’ portfolio includes real estate funds and individual cash-flow-generating properties, but we also develop and improve real estate ourselves.

Figure 1. Allocation of LHV pension fund assets as of 31.10.2025.

At a time when risk-free bonds had negative interest rates and therefore guaranteed a loss if held to maturity, we reached precious metals as lower-risk alternatives. For millennia they have served as a store of value and as a means of protecting and preserving wealth.

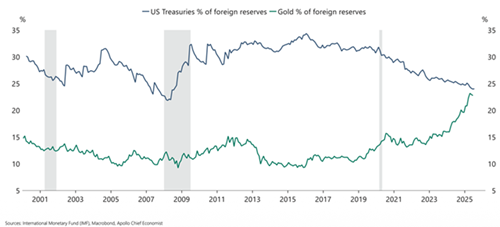

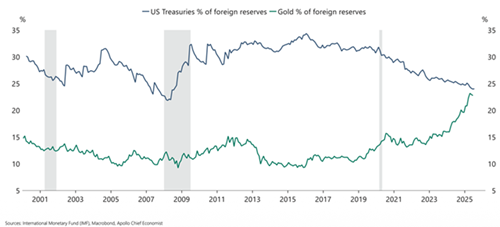

In recent years, gold has regained its shine. The gold reserves of the world’s largest central banks are likely soon to surpass the volume of reserves they hold in US dollars.

Figure 2. Share of US Treasury bonds (blue line) and gold (green line) in the foreign-currency reserves of the world’s central banks, 2001–2025. Source: Apollo Global Management.

The strong rise in the gold price in recent years points both to growing geopolitical risks and to a global economic environment becoming increasingly fragile due to rapidly expanding debt burdens everywhere. It also highlights some of the shortcomings of today’s monetary system.

LHV’s broad investment team

Most LHV pension funds are actively managed. At LHV, active management does not simply mean choosing stocks and bonds on a computer screen and clicking buy or sell.

LHV pension funds have three fund managers: in addition to myself, Romet Enok and Kristo Oidermaa. I look at the world and markets more broadly, try to stay up to date with different asset classes, and understand their interrelations and effects. Kristo analyses everything related to companies’ equity, and Romet everything related to their debt. Alongside the three fund managers, the head of LHV Asset Management, Vahur Vallistu, keeps an eye on all investments. As a former banker, he knows Estonian companies and the local loan and debt markets well.

Simply put, all our investments can be divided into equity or debt investments, including real estate, various funds and investment projects.

The LHV equities team has six members: Kaius Kiivramees, Mikk Taras, Jani Mäenpää, Georg Martin Leppsalu, Karl Tani Priilinn-Türk and Robert Raasuke. The bond markets are handled by Martin Möllits and Elis Ronk.

The LHV pension funds’ real estate team invests in cash-flow-producing projects and also develops real estate itself. The team has three members: Rait Riim, Marek Soop and Joona-Liis Joost.

Private-equity and venture-capital investments are managed by Sigrid Lii Treial, and index funds are overseen by Erko Rebane.

The investment team also includes Heido Vitsur, who helps make sense of social processes at home and globally, and Helerin Kaldvee, who supports us with legal matters related to investments.

In addition, we have separate legal and risk-control units, as well as the entire “back office” of LHV Asset Management. Its members support the investment team and ensure that all payments are made, interest and dividends are received, and that all necessary reports are prepared for the investment team, supervisory authorities, and company management.

LHV Asset Management has always taken care of the development of its investment team and the improvement of processes to achieve the highest possible returns for clients at a reasonable level of risk. We do not believe that all assets should be allocated to stock markets, but we do offer funds for those who want maximum equity risk.

LHV Asset Management investment team in the Marati House, owned by the pension funds.

Active vs passive management

Over the past eight years, discussions about pension fund investments in Estonia have largely boiled down to contrasting passive and active funds and comparing costs.

Everyone understands that the goal of Estonian pension index funds is to achieve the market’s average return with minimal costs. To do this, the pension savers’ assets are invested in index funds listed on the US or European stock exchanges.

But there has been little discussion about what is and is not active management. Estonian legislation also does not precisely or bindingly define what constitutes a passive fund or a passive investment strategy. Therefore, many questions remain unanswered.

Is a fund that mostly invests in the same or similar US and European index funds as the index fund offered by the same manager — and which achieves almost identical long-term returns but charges higher fees — an actively managed fund, or simply an index fund with high fees?

Or does an index fund become an actively managed fund merely because high fees are spent on aggressive sales services purchased from external providers? Where is the line that qualifies as misleading clients?

I also wonder whether it is misleading when a fund manager promises to significantly increase investments in the Baltic markets despite lacking the team — and likely a clear plan — to actually do so.

I believe that the existence of an investment team could be one criterion for assessing whether a fund is active or passive, and whether charging higher fees than an index fund is appropriate if the fund does not even have an investment team.

Looking at the history of the Estonian pension fund market, we can note that several originally active funds have downsized their teams over the years and limited their strategies mainly to investing in other index funds. By doing so, they have sought to maintain the profitability of the asset-management company in a situation where fees that fund managers are allowed to charge have been increasingly restricted by law. How should we view this? Most likely, no law has been directly violated, but that does not mean clients have not been misled — being given the impression that the fund is actively managed and therefore charges high fees, when in reality the strategy has gradually become passive.

I do not think everything needs to be strictly regulated by law. Sometimes it is enough for the supervisory authority to ask questions of a company that seems to be pushing boundaries too far. There are also industry standards. Ideally, market participants themselves should ensure fair competition.