January 2026: Commodities made a positive contribution

Kristo Oidermaa and Romet Enok, Fund Managers

In January, following the sharp rise in metals prices, we reduced our exposure to metals-related investments in order to lower risk. On the buying side, we focused on the energy sector. The biggest contributors to monthly performance were metals-related positions and Fortum Oyj, which is linked to the electrification trend. We remain cautious, expecting that widening government budget deficits could stimulate the economy and markets, but we balance this by maintaining investments in commodities to hedge the inflation risk that may result.

In January, the S&P 500 rose by 1.4% in USD terms and by 0.2% in EUR terms, while the Euro Stoxx 50 gained 2.8% in EUR terms. The strong rise in metal prices continued in the first month of the year: gold, silver and copper appreciated by 13%, 19% and 5% in USD terms, respectively. The emerging markets index climbed 9% in USD terms, driven largely by Latin American markets. The OMX Baltic Benchmark index increased by approximately 0.7% in EUR terms.

Latvian premium chocolate truffle producer Pure Chocolate completed a management buyout, acquiring a controlling stake from BaltCap Latvia Venture Capital Fund, the previous owner. The transaction, worth more than EUR 3 million, was financed by BluOr Bank and supported by the state development fund ALTUM. As a result, the company will remain in Latvia: the new controlling owners are three Latvian entrepreneurial families, ensuring Pure Chocolate’s long-term development in its home market. According to Chairman of the Management Board Normunds Sala, the deal was a strategic step to preserve a strong Latvian brand and accelerate its international growth.

December 2025: a successful year comes to a close

Kristo Oidermaa and Romet Enok, Fund Managers

In December, U.S. markets mostly moved sideways. Measured in dollars, the S&P 500 posted a full-year return of 16.4% and the Nasdaq Composite 20.4%, but due to the weakening of the dollar, returns measured in euros were much lower — 2.6% and 6.1% respectively.

Europe’s Euro Stoxx 50 rose by 2.2% in euro terms during December, with Austria, Spain and Finland making the biggest contributions by country. The emerging markets index gained 2.7% in dollar terms, driven mainly by Korea, Peru and Chile. The OMX Baltic Benchmark index increased by 4.8% in euro terms in December.

The main winners of the past year were Europe (up 21%), South America (46%), Africa (54%) and Asia (30%) rather than the United States. Metals were also very strong: gold rose 65%, silver 148%, copper 43% and palladium 97%. Oil was weak in 2025, with West Texas Intermediate (WTI) crude falling 20% over the year. The OMX Baltic index rose 19% last year.

In the final month of 2025, we did not make any major transactions in the equity portfolios. The largest contributors to the fund’s performance in December were metals linked to electrification, a European banks index fund, and gold-related investments.

Looking at the year as a whole, the fund’s 13.3% return was shaped largely by the same factors as in December. In 2025, the U.S. dollar was a major loser, but we have hedged this risk in our portfolios using derivatives.

Going forward, we see interesting opportunities across the world. For example, in Europe and Asia, rising government budget deficits could support economic growth and markets, while in South America a weaker dollar supports attractive opportunities. There is also an increased chance that inflation will accelerate in 2026, which is why we consider commodities to be a critical part of the fund’s portfolio.

In December, Netflix acquired Ready Player Me, a company founded by Estonian entrepreneurs that had been part of the fund’s venture capital portfolio. The company’s solution allows users to create a single virtual character (avatar) that can be used across many games and applications. The process is simple: the user takes a photo, and the system generates a 3D model from it. This is also useful for game developers, who no longer need to build complex character systems from scratch. Netflix wants its games to be more interconnected, and thanks to this deal, players will be able to use their avatar across multiple Netflix games, making the gaming experience more personal and social. The company had previously been in the portfolios of the venture capital fund Plural and Trind Ventures.

November 2025: Gold helped withstand the nervousness in equity markets

Kristo Oidermaa and Romet Enok, Fund Managers

November was volatile in equity markets. This was driven by concerns over the high valuation multiples of companies related to artificial intelligence and uncertainty over how profitable the massive investments into AI data centres will ultimately be.

The S&P 500 and Euro Stoxx 50 indices ended the month at the same level where they started. Since the beginning of the year, they have risen 16.4% and 18.6% respectively in their local currencies. Measured in euros, the S&P 500 has gained only 4% year-to-date, as the dollar has weakened against the euro.

The Nasdaq Composite index fell 1.5% in November in dollar terms. The price of a barrel of WTI oil declined 4% over the month in dollars and is down 18% since the start of the year. The emerging markets index lost 2.5% in dollar terms during the month, bringing its year-to-date return to 27%. The most profitable emerging-market region this year has been Latin America, up 47% since the start of the year. The OMX Baltic Benchmark index rose 1.9% in November in euro terms.

We did not make any major purchases in November. The biggest contributors to performance during the month were our gold-related positions, the European banks index fund, and companies associated with natural gas.

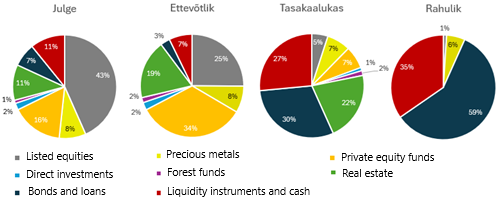

In the portfolios, we invest in high-quality and niche-strong companies in the United States, the Nordic countries, and Central Europe. In the United States, we have hedged the portfolio’s exposure to the US dollar through a derivative instrument, as we see currency risk as the largest risk in investing there. In addition, we hold investments with exposure to commodities, which offer protection against inflation.

October 2025: Metals and Nordic companies drove performance

Kristo Oidermaa and Romet Enok, Fund Managers

October continued on an optimistic note in the U.S. markets, with the S&P 500 and Nasdaq Composite indices rising in dollar terms by 2.3% and 4.7%, respectively. Since the beginning of the year, the S&P 500 has gained 16.3%. The Euro Stoxx 50 index increased by 2.5% in euro terms in October.

The emerging markets index rose by 4.1% in dollar terms last month, although its largest component, China, had to settle for a 3.9% decline. Emerging markets were driven by South Korea and Taiwan, where several semiconductor companies have benefited significantly from the large-scale construction of data centers. The OMX Baltic Benchmark Index, measured in euros, fell by 1.4%.

In October, we increased our investments in the Nordic countries and Central Europe while reducing our exposure to energy-related metals. Among new names, we added Addtech AB and Adidas to the portfolio and further increased our position in Indutrade.

The biggest contributors to the fund’s performance in October were precious metals and energy-related metals, while Nordic companies also delivered solid results. We continue to see good opportunities in the Nordics. We have been investing there for a long time, as the region is home to strong and well-managed companies that are leaders in their niches. We believe the outlook for the industrial sector in the Nordics is improving, and this is not yet reflected in stock prices.

In the fund’s private equity portfolio, the Switzerland-based private equity firm Partners Group sold its 25% stake in the global logistics company Apex Logistics last month. The transaction valued Apex Logistics at more than USD 4 billion and delivered strong returns to Partners Group’s investors. Working together with the majority owner, Kuehne+Nagel, Partners Group helped the company grow from a regional transport provider into an international logistics platform by expanding air freight capacity, strengthening its service offering, and developing technological solutions for servicing major clients. Apex Logistics serves more than 20,000 customers in over 70 countries. The sale of the stake provides Apex with an opportunity to continue its growth supported by Kuehne+Nagel’s global network.

September 2025: We increased investments in Europe

Kristo Oidermaa and Romet Enok, Fund Managers

September continued with a positive sentiment in U.S. markets, with the S&P 500 and Nasdaq Composite indices rising by 3.5% and 5.6% in dollar terms, respectively. European markets also performed well, with the Euro Stoxx 50 increasing by 3.4% in euro terms. Emerging markets gained 7% in dollar terms, with the index’s largest member, China, rising by as much as 9.5%. In contrast, the Baltic OMX Baltic Benchmark index fell by 2% in euro terms over the month.

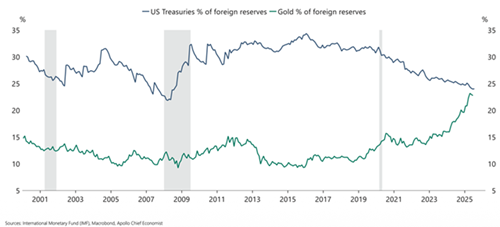

During the month, we increased investments across various industries in Europe. The largest contributors to September’s returns were investments exposed to electrification and precious metals. We continue to see strong potential in precious metals, supported by a weakening dollar, easing monetary policy, and significant central bank purchasing interest.

In September, U.S.- and Israel-based cybersecurity company Cyberbit acquired the Estonian-founded company Rangeforce, which was part of the Trind Ventures portfolio — one of the fund’s investments. With this acquisition, Cyberbit aims to build a global platform combining individual skill development and team-based cyber crisis simulations. The deal strengthens Cyberbit’s position as a leading provider of cyber training, offering organizations a comprehensive solution from employee training to realistic attack simulations. Rangeforce’s cloud-based learning environment complements Cyberbit’s real-time exercise capabilities, expanding its training portfolio for both individuals and teams.

August 2025: Gold continues to support fund performance

Kristo Oidermaa and Romet Enok, Fund Managers

August was a positive month for US markets, with the S&P 500 and Nasdaq Composite rising 1.9% and 1.6% respectively in dollar terms. The Euro Stoxx 50 gained 0.6% in euros, while emerging markets were up 1.2% in dollars. Within that, China rose 4.9% and Latin America 7.5%. Closer to home, the OMX Baltic Benchmark Index ended the month where it started.

Donald Trump’s attempts to curb the independence of the Federal Reserve, and expectations that the Fed will ease monetary policy, have boosted investor demand for gold. As a result, our large gold position was again the biggest contributor to performance in August.

Gold mining companies were particularly strong last month, gaining about 24%. Investments linked to electrification also performed well, rising about 8%. We have hedged the dollar exposure on our US equities with a derivative instrument, which also made a significant contribution in August given the weaker dollar.

We continue to see attractive opportunities in German equities, supported by the government’s planned large-scale spending on infrastructure and defence.

In the private equity portfolio, Astorg acquired a stake in Germany’s leading insurance broker Attikon. This strengthens the company’s position as a key intermediary in commercial insurance. Attikon has quickly grown to become one of the three largest residential real estate brokers in Germany, serving more than 30,000 clients across five major cities. The investment will accelerate its M&A strategy, increase digitalisation and support expansion into new service areas.

As a result of these developments, Attikon has become a growing platform with around 230 employees, a strong presence in attractive niche markets and ambitions to become one of Germany’s leading brokerage groups. The investment was made through Astorg’s Mid-Cap fund, its seventh deal but the first in the business services sector. Astorg itself manages more than €23 billion in assets, operating across Europe and the US, with a focus on healthcare, software and technology, and business services.

July 2025: Attractive outlook for the German economy

Kristo Oidermaa and Romet Enok, Fund Managers

July brought continued gains in US markets, with the S&P 500 and Nasdaq Composite rising by 2.2% and 3.7% in dollars. The euro zone’s Euro Stoxx 50 gained 0.4% over the month in euro terms. Emerging markets were up 1.7% in dollar terms, with China – the index’s largest component – adding 4.5% in dollars. Latin America fell by 4.6% in dollars, while the Baltic OMX Baltic Benchmark Index rose by 2.4% in euros.

Last month, we increased our exposure to Germany, as the infrastructure fund planned by Friedrich Merz’s government and the accompanying rise in the budget deficit are set to stimulate the country’s economy. New additions to the portfolio included Ionos Group, Lanxess, Vossloh and SigmaRoc.

The strongest contributions to the fund’s July performance came from European banks, gold-related positions and US companies open to growth in industrial investment in critical sectors. In the US, we continue to see the dollar as the main risk, which is why we have fully hedged our US equity exposure against currency fluctuations.

In the private equity portfolio, Piletilevi acquired full ownership of its Romanian operations, enabling the company to now offer the country’s most comprehensive ticketing service. This move reinforces Piletilevi’s investment thesis for Central and Eastern Europe: in June, the portfolio added Ticketportal in the Czech Republic and Slovakia, consolidating local market players under one roof and increasing bargaining power with partners, advertising channels and payment providers. As a result of all acquisitions completed to date, Piletilevi’s ticket sales volume now exceeds €600 million, with more than 21 million tickets sold annually.

In the bond portfolio, AS Ekspress Grupp repaid its loan ahead of schedule. LHV pension funds had made a direct investment in the company in the form of bonds in 2018, with the funds used primarily to grow Ekspress Grupp’s digital subscription model for its media outlets. The company’s development has now reached a point where our bond investment has been replaced with a bank loan.

June 2025: Markets continued on an upward trend

Kristo Oidermaa and Romet Enok, Fund Managers

In June, the S&P 500 rose by 5% in dollar terms, returning to record highs, but due to the weaker dollar, the euro-denominated gain was just 1.3%. The Euro Stoxx 50 fell by 1.1% in euros. The emerging markets index rose 5.7% in dollars, with China – its largest component – up 3.1%. The OMX Baltic Benchmark Index declined by 0.7% in euros.

Markets continued to rally in June, with the S&P 500 back at record levels. The rally has been supported by expectations of major budget deficits under President Trump, strong labour market figures, and a growing belief that the trade war he initiated is now behind us. Top contributors to returns in June included names linked to copper and silver, as well as our position in Fortum, which has benefited from rising electricity prices in Scandinavia. The dollar continued to weaken against the euro, and we still see it as the main risk in US equities – which is why we have fully hedged our dollar exposure using derivatives. We continue to find strong opportunities in European equities, particularly in German names, which stand to benefit from the country’s widening budget deficit.

May 2025: Recovery of markets after the trade war

Kristo Oidermaa and Romet Enok, Fund Managers

In May, the S&P 500 rebounded by 6.2% in dollar terms, bringing year-to-date performance to +0.5%. The tech-focused Nasdaq Composite rose by around 10% for the month, and the Euro Stoxx 50 gained 5.1% in euros. Emerging markets were also up, with the index rising 4% in dollars – China, the largest constituent, advanced 2.4%. The OMX Baltic Benchmark Index was up 4.4% in euros.

Markets continued to recover from Donald Trump’s tariff war, which began on 2 April with “Liberation Day”. For now, investors see little risk of further escalation. Among the strongest contributors to performance in May were Germany’s mid-cap index, the European banks index, US companies exposed to industrial investment growth, and gold mining stocks, which have proven resilient in a highly volatile environment. Our exposure to US equities remains low. Within the US, we focus on companies linked to industrial investment in critical sectors such as semiconductor manufacturing and data centre development. We see the US dollar as the main risk, which we have fully hedged in our US equity positions. We continue to find strong opportunities in European equities, particularly in German names, which stand to benefit from the country’s widening budget deficit.

One of the fund’s largest holdings, Eesti Energia, issued public bonds aimed at local investors. The company raised funds for three years at a 5% interest rate. Last July, we invested in the longer-term subordinated bonds that Eesti Energia had issued to the European market. Their current expected return is around 7% annually, and the fund has earned nearly 9% since July. Raising fresh capital through a mix of instruments enables the company to increase its investment activities.

April 2025: Trump’s rollercoaster ride

Kristo Oidermaa and Romet Enok, Fund Managers

April started off poorly for markets, which were shaken by Donald Trump’s “Liberation Day” and the renewed trade war. However, a subsequent pause in tariff measures and easing tensions led to a strong rebound. The S&P 500 index ended the month down 0.8% in dollar terms. The European Euro Stoxx 50 index fell by 1.2% in euros, while emerging markets gained 1% in dollars. Latin America – particularly Mexico and Brazil – along with India led the way. China’s market declined by 4.6% in dollars. The OMX Baltic Benchmark index dropped 0.4% in euros.

Over the month, we traded the German DAX index to take advantage of the volatility and uncertainty driven by the trade war. We also exited our positions in DSV, Carlsberg and the Russell 2000 ETF. The strongest contributor to monthly performance was Fortum, which rose 6.8%, following better-than-expected quarterly results. Other positive contributors included the German MDAX ETF, up 2.85%, and our physical gold holding, which rose by 1.84%. The main detractors were our energy and energy metals holdings, which declined by 10–24%, Alibaba, down 14.6%, and gold miner Barrick Gold, which fell by approximately 5.6%. Over the past few months, we have added positions in Germany, where we see long-term potential stemming from larger government budget deficits – a development we believe could support local stock markets.

BaltCap, the largest private equity fund in the Baltics, announced the sale of Ridango, an Estonian technology firm operating in international markets, to its new owner – Bregal Milestone, a leading European software investor. BaltCap acquired a majority stake in Ridango in 2020 and supported the company’s rapid growth both organically and through acquisitions. Although the company’s largest office is currently in Estonia, plans are underway to relocate its headquarters to Sweden to facilitate future mergers and acquisitions. Ridango operates in multiple markets, providing automated fare collection and real-time passenger information solutions.

One of our major investments concluded in April when Lithuania’s Šiaulių Bankas repaid its subordinated bond. Between 2016 and 2019, we made subordinated bonds issued by local Baltic banks a key component of our portfolio. Šiaulių was the last of these investments – and now it is also the last to return capital. Over the years, the investment delivered an annual interest of 6.15%, a return that compares favourably even to most global stock market indices over the same period.