Explanations of pension calculator

For long-term investing, the return on investment, which is the investment profit by which the saved amount will grow, is of decisive importance. A pension calculator gives a simplified overview of the roles played by contributions made from the salary of the person saving and the yield of the pension fund when saving.

By using a comparison, it is possible to also examine the result in the case of the long-term average annual yield of Estonian pension funds. In this case one should still remember that the yield of previous periods does not guarantee future performance.

Calculator settings

- By default, the minimum age is 18 years old, the maximum - old-age pension, the general age of which starting from 01.01.2017 is 65.

- Accumulated for today - to enter a more detailed amount, check your pension account on LHV’s pension website for example, where you can view your details regardless of what your home bank is. Minimum is 0, maximum 150 000 €.

- Average yield - the yield of funds may be positive as well as negative. You can view the yields of funds here or on the homepage of the Pension Centre.

- Gross salary – since it is a simplified option for calculating the funds accumulated until retirement, by default, the calculator will consider for monthly gross income that the average 1.5% growth estimated by the European Commission extends to it. Minimum is 400, maximum 15 000 €.

Calculator formulas

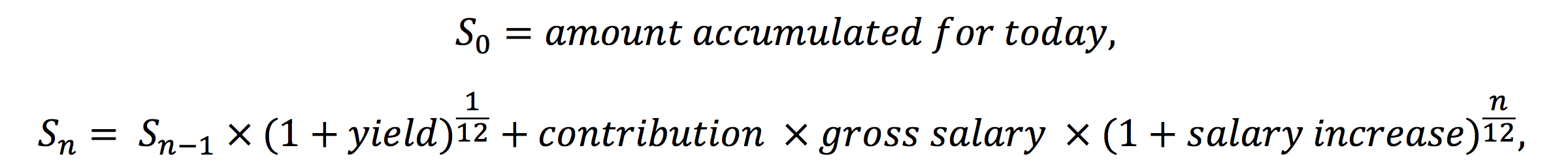

- Amount saved in pillar II – the amount you have accumulated in pillar II upon reaching retirement age (considering the current regulations) is calculated by using the formula:

where n = months to retirement (n = 1, 2, 3, ...) - Your contribution – amount paid into the pillar II pension fund by the customer from the salary

- State’s contribution – amount paid into the pillar II pension fund by the state

- Yield – amount added into/deducted from the pillar II pension fund as a result of the yield.

Constants

- Annual salary increase – 1.5% per year, as estimated by the European Commission.

- Retirement age – 65 years old.

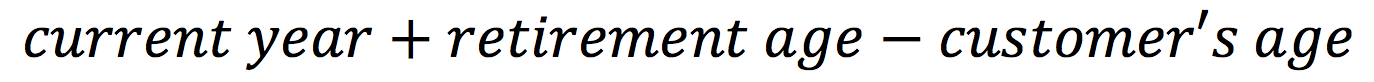

- The time of retirement is calculated by using the formula:

- Contributions – for simplicity, it is assumed that contributions constitute 6% of the gross salary for everyone.

Contributions from salary – for simplicity, it is assumed that contributions constitute 2% of the gross salary for everyone.

The pension calculator's calculations are based on the data entered in the calculator by the user. The rates of return of the entered pension funds and other investments fluctuate over time and their value may rise or fall. It must be taken into consideration that higher rates of return are accompanied by greater risks and a previous rate of return is not a guarantee of the same rate of return in the future. The pension amount found with the help of the calculator is, above all, a forecast, and may differ from the actual pension received. When calculating your future pension, the calculator relies on applicable regulations, including the State

Pension Insurance Act and the Funded Pensions Act, which may change over time. The results provided by the calculator are illustrative and should not be treated as an investment recommendation. Before making a specific investment, including into the 2nd or 3rd pension pillar, you should review the prospectus for the specific fund and consult with a specialist.