Guide for Ruble Payments

23.11.2021

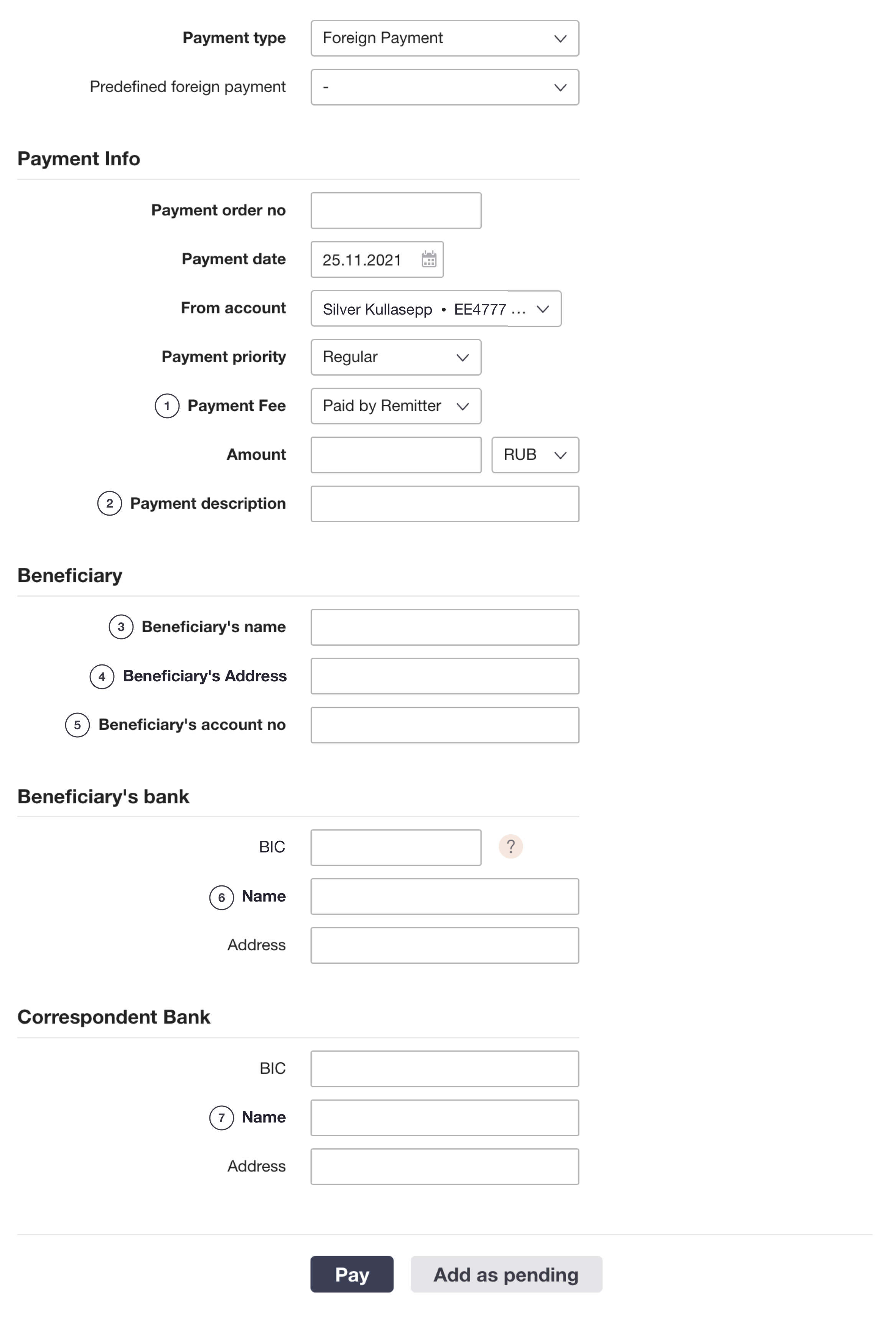

Payment order form

1. Payment fee.. Choose Paid by Remitter

2. Payment description.. Please review the payment description requirements before completing this field

3. Beneficiary's name.. INN code. KPP code beneficiary´s name

4. Beneficiary's Address.. Address, city

5. Beneficiary's account no

6. Beneficiary's bank name.. BIK code. Account of the beneficiary's bank in the Central Bank of the Russian Federation Name of beneficiary´s bank

7. Correspondent Bank's name. Fill in the field if the beneficiary's bank is a branch

Definitions

Payment fee

Russian banks only accept payment orders in rubles where the full amount goes to the beneficiary (OUR).

Payment description

The details of the payment description must be in Russian written in Latin alphabet according to the transliteration table

- The total number of characters allowed in the payment description is 140.

- The codes must be preceded by their type, eg VO, KBK.

- In the payment description, the codes must be separated by a space.

The content of the payment description depends on the reason for the payment - payment of the invoice, taxes or fee.

Reason for payment: Payment of the invoice

| VO code | Mandatory |

| Verbal explanation of the content of the payment (name of the good or service) | Mandatory |

| Invoice or contract number, date | Mandatory |

| The amount of VAT (NDS) | Mandatory If the goods or services are not subject to tax, then you have to write BEZ NDS |

For example, paying an invoice with VAT '(VO10100)' ZA UGOLX PO DOGOVORU NO55 01.01.2020 NDS 500 RUB

For example, paying an invoice without VAT '(VO10100)' ZA UGOLX PO DOGOVORU NO55 01.01.2020 BEZ NDS

Reason for payment: Payment to the budget of the Russian Federation (fine, fee, etc.)

| Budget payments will be made to the following beneficiary account numbers: | 40101xxxxxxxxxxxxxxx 40302xxxxxxxxxxxxxxx 40501xxxxxxxx2xxxxxx 40503xxxxxxxx4xxxxxx 40601xxxxxxxx1xxxxxx 40601xxxxxxxx3xxxxxx 40603xxxxxxxx4xxxxxx 40701xxxxxxxx1xxxxxx 40701xxxxxxxx3xxxxxx 40703xxxxxxxx4xxxxxx |

| VO code | Mandatory |

| KBK code | Mandatory |

| OKTMO code | |

| Payer´s code | Mandatory Payer's personal identification code or Tax payer number |

| Verbal explanation of the content of the payment | Mandatory |

For example

'(VO10100)' KBK39393939393939393939 OKTMO45454545 ///EE,EE01001,KD1717177/// VZNOSY

Beneficiary's name

Field format: INN code. KPP code Beneficiary´s name

For example: INN5555555555.KPP666666666 OOO GGGGG

The beneficiary's name in Russian written in Latin alphabet according to the transliteration table.

The beneficiary's surname, first name and patronymic must be entered if the beneficiary is a private individual. The type of ownership (OOO, OAO, ZAO; IP etc. in the case of a private undertaking) must be indicated for a beneficiary who is a legal entity.

If the beneficiary's name is too long, it must be continued in the address field.

Beneficiary's account no

The beneficiary's 20-digit ruble current account number, where the first digit is 4, the second 0, the sixth 8 and the seventh 1

Beneficiary's Address

Mandatory.The beneficiary's address and city in Russian written in Latin alphabet according to the transliteration table.

Beneficiary's bank name

Field format: BIK code of Beneficiary´s bank. Account of the beneficiary's bank in the Central Bank of the Russian Federation Name of beneficiary´s bank

For example: RU044111111.30111111100000000111 AO XXX Bank

Name of the beneficiary's bank in Russian written in Latin alphabet according to the transliteration table.

Beneficiary's bank address

Address and city of the beneficiary's bank in Russian written in Latin alphabet according to the transliteration table.

Name of the correspondent account of the beneficiary's bank

Name of the correspondent account of the beneficiary's bank

Fill in the field if the beneficiary's bank is a branch

Field format: Main bank´s BIC code.number of the branch's correspondent account in the main bank Name of the main bank

For example:

Account of the beneficiary's bank: RU044111111.30311111100000000111 AO XXX Bank

Name of the correspondent account of the beneficiary's bank: RU04xxxxxxx.301xxxxxxxxxxxxxxxxx AO YYY Bank

VO Code

Foreign currency transaction (also foreign currency operation, VO) code – the five-digit code required by the Central Bank of Russia, which must correspond to the information written in the details field. List of transaction codes (VO codes).

Please note: Entering and submitting the foreign currency transaction code on international payments is mandatory. Payments made without the VO code are returned. We advise you to ask your foreign partner to give you the VO code, or to agree about it when you sign the contract. Foreign currency transaction codes must always be determined on the basis of residency with regard to Russia. If resident of Estonia makes a payment to a resident of Russia, then the payer is the non-resident with regard to Russia, and the beneficiary is a resident.

KBK number

20-digit number for payment of the Russian Federation's fines, fees and other charges; may not contain letters, spaces or other characters.

OKTMO code

код Общероссийского классификатора территорий муниципальных образований, Venemaa kohalike omavalitsuste klassifikatsioonikood, mida kasutatakse statistilistel ja seadusandlikel eesmärkidel. 8-kohaline kood, mis ei sisalda tähti, tühikuid ega muid märke.

Payer´s code

Payer's personal identification code or Tax payer number

Payer is not registered with the tax authority of the Russian Federation

| Juridical person | Write between slashes (///): Country code, 2 letters where the VAT number is issued VAT number | Fill in the payment description field '(VO10100)' KBK39393939393939393939 OKTMO45454545 ///EE,EE191919199/// description |

| Private person | Write between slashes (///): Country code, 2 letters where the payer's identity document is issued (eg passport) Document type identifier, 7 alphanumeric characters. Eg EE01001 - Estonian passport / ID card identifier. Payer's document number | Fill in the payment description field '(VO10100)' KBK39393939393939393939 OKTMO45454545 ///EE,EE01001,KD1717177/// description |

Payer is registered with the tax authority of the Russian Federation

| Juridical person | Payer´s INN and KPP code. Codes are separated by periods. | Fill in the payment description field '(VO10100)' KBK39393939393939393939 OKTMO45454545 INNxxxxxxxxxx.KPPyyyyyyyyy payment description |

| Private person | Payer's INN code | Fill in the payment description field '(VO10100)' KBK39393939393939393939 OKTMO45454545 INNxxxxxxxxxxxx payment description |

INN code

Идентификационный номер налогоплательщика, Tax resident code of the Russian Federation. If the tax resident is a legal entity, the code is 10 digits. The personal identification number has 12 digits.

KPP code

Код причины постановки на учет, 9-digit code to be provided on payment documents when paying taxes, state fees and other mandatory budget payments in the Russian Federation.

BIK code

Банковский идентификационный код, 9-digit code of the beneficiary's bank. Write in the form RUXXXXXXXXX, always starting with the numbers 04.

Account of the beneficiary's bank

Correspondent account of the beneficiary's bank in the Central Bank of the Russian Federation – 20-digit account number, which always starts with '301' and whose last three digits match the last three digits of the BIK code.

For example: RU044111111.30111111100000000111 AO XXX Bank

If the beneficiary's bank is a branch, the 20-digit account number starts with the number combination "303" and in addition the correspondent account name field of the beneficiary's bank must be filled in.

For example: RU044111111.30311111100000000111 AO XXX Bank

Name of the correspondent account of the beneficiary's bank: RU04xxxxxxx.301xxxxxxxxxxxxxxxxx AO YYY Bank

List of transaction codes (VO codes)

Annex 2 to the Instruction of the Bank of Russia № 138-I as of June 4, 2012 “On the Procedure for Residents and Non-Residents to Submit Documents and Information on Currency Operations to Authorised Banks, Procedure for Drawing up Transaction Certificates and Procedure for Authorised Banks to Register Currency Operations and control Them”

LIST of Currency and Other Operations of Residents and Non-Residents

| Code of operation type | Name of operation type |

|---|---|

| 01 | Non-cash currency exchange operations of residents |

| 01 010 | Sales of foreign currency by residents using the currency of the Russian Federation |

| 01 030 | Purchase of foreign currency by residents using the currency of the Russian Federation |

| 01 040 | Purchase (sales) of a foreign currency by residents for another foreign currency |

| 02 | Non-cash currency exchange operations of non-residents |

| 02 010 | Purchase of currency of the Russian Federation by non-residents for foreign currency |

| 02 020 | Sales of currency of the Russian Federation by non-residents for foreign currency |

| 10 | Settlements between residents and non-residents during foreign trade activities related to export of goods, including aircrafts, marine and inland vessels and space objects, from the territory of the Russian Federation |

| 10 100 | Settlements of non-residents as prepayments to a resident for goods exported from the territory of the Russian Federation, including on the basis of a commission contract (agency contract, authorisation contract) prepayment), except for settlements specified in section 22 of the List |

| 10 200 | Settlements of non-residents related to granting of deferral of payment for goods exported by a resident from the territory of the Russian Federation, inter alia on the basis of a commission contract (agency contract, authorisation contract) (instalment), except for settlements specified in section 22 of the List |

| 10 800 | Settlements of residents in favour of a non-resident related to returning excess funds received upon export of goods from the territory of the Russian Federation, except for settlements with code 22800 |

| 11 | Settlements between residents and non-residents during foreign trade activities related to import of goods, including aircrafts, marine and inland vessels and space objects, to the territory of the Russian Federation |

| 11 100 | Settlements of residents as prepayments to a non-resident for goods imported to the territory of the Russian Federation, inter alia on the basis of a commission contract (agency contract, authorisation contract) (prepayment), except for settlements specified in section 23 of the List |

| 11 200 | Settlements of residents related to granting of deferral of payment for goods imported by a non-resident to the territory of the Russian Federation, inter alia on the basis of a commission contract (agency contract, authorisation contract) (instalment), except for settlements specified in section 23 of the List |

| 11 900 | Settlements of non-residents in favour of a resident related to returning excess funds received upon import of goods to the territory of the Russian Federation, except for settlements with code 23900 |

| 12 | Settlements between residents and non-residents for sales of goods without importing the goods to the territory of the Russian Federation |

| 12 050 | Settlements of non-residents in favour of a resident for goods sold outside the territory of the Russian Federation without importing them to the territory of the Russian Federation, except for settlements with codes 22110, 22210, 22300 |

| 12 060 | Settlements of residents in favour of a non-resident for goods sold outside the territory of the Russian Federation without importing them to the territory of the Russian Federation, except for settlements with codes 23110, 23210, 23300 |

| 12 800 | Settlements of residents in favour of a non-resident in relation to returning excess funds received upon sales of goods outside the territory of the Russian Federation, except for settlements with code 22800 |

| 12 900 | Settlements of non-residents in favour of a resident in relation to returning excess funds received upon sales of goods outside the territory of the Russian Federation, except for settlements with code 23900 |

| 13 | Settlements between residents and non-residents for sales of goods sold on the territory of the Russian Federation |

| 13 010 | Settlements of non-residents in favour of a resident for goods sold on the territory of the Russian Federation, except for settlements with codes 22110, 22210, 22300 |

| 13 020 | Settlements of residents in favour of a non-resident for goods sold on the territory of the Russian Federation, except for settlements with codes 23110, 23210, 23300 |

| 13 800 | Settlements of residents in favour of a non-resident in relation to returning excess funds received upon sales of goods on the territory of the Russian Federation, except for settlements with code 22800 |

| 13 900 | Settlements of non-residents in favour of a resident in relation to returning excess funds received upon sales of goods on the territory of the Russian Federation, except for settlements with code 23900 |

| 20 | Settlements between residents and non-residents during foreign trade activities in relation to works to be performed, services to be provided and information and results of intellectual activities (including their exclusive rights) to be submitted by residents |

| 20 100 | Settlements of non-residents as prepayments to a resident for works to be performed, services to be provided and information and results of intellectual activities (including their exclusive rights) to be submitted by the resident, inter alia when such obligations are fulfilled on the basis of a commission contract (agency contract, authorisation contract) (prepayment), except for settlements specified in section 22 of the List and settlements related to payment of remuneration to a resident broker on the basis of a brokerage contract (section 58 of the List) |

| 20 200 | Settlements of non-residents to a resident for works performed, services provided and information and results of intellectual activities (including their exclusive rights) submitted by the resident, inter alia when such obligations are fulfilled on the basis of a commission contract (agency contract, authorisation contract) (instalment), except for settlements specified in section 22 of the List and settlements related to payment of remuneration to a resident broker on the basis of a brokerage contract (section 58 of the List) |

| 20 500 | Settlements of resident commissioners (agents, guarantors) in favour of a non-resident commitent (principal) related to services provided by the resident to other persons, such as sales of goods, performance of works, provision of services, submission of information and results of intellectual activities (including their exclusive rights) of the non-resident on the basis of a commission contract (agency contract, authorisation contract), except for settlements specified in section 58 of the List |

| 20 800 | Settlements of residents in favour of a non-resident related to returning excess funds received upon goods sold, works performed, services provided and information and results of intellectual activities (including their exclusive rights) submitted by the resident, except for settlements specified in sections 22 and 58 of the List |

| 21 | Settlements between residents and non-residents during foreign trade activities related to performance of works, provision of services and submission of information and results of intellectual activities (including their exclusive rights) by non-residents |

| 21 100 | Settlements of residents as prepayments to a non-resident for works to be performed, services to be provided and information and results of intellectual activities (including their exclusive rights) to be submitted by the nonresident, inter alia when such obligations are fulfilled on the basis of a commission contract (agency contract, authorisation contract), except for settlements specified in section 23 of the List and settlements related to payment of remuneration to a non-resident broker on the basis of a brokerage contract (section 58 of the List) |

| 21 200 | Settlements of residents for works performed, services provided and information and results of intellectual activities (including their exclusive rights) submitted by a non-resident, inter alia when such obligations are fulfilled on the basis of a commission contract (agency contract, authorisation contract) (instalment), except for settlements specified in section 23 of the List and settlements related to payment of remuneration to a nonresident broker on the basis of a brokerage contract (section 58 of the List) |

| 21 500 | Settlements of non-resident commissioners (agents, guarantors) in favour of a resident commitent (principal) related to services provided by the nonresident to other persons, such as sales of goods, performance of works, provision of services and submission of information and results of intellectual activities (including their exclusive rights) of the resident on the basis of a commission contract (agency contract, authorization contract), except for settlements specified in section 58 of the List |

| 21 900 | Settlements of non-residents in favour of a resident related to returning excess funds received upon goods sold, works performed, services provided and information and results of intellectual activities (including their exclusive rights) submitted by the non-resident, except for settlements specified in sections 23 and 58 of the List |

| 22 | Settlements between residents and non-residents related to goods delivered, works performed, services provided and information and results of intellectual activities (including their exclusive rights) submitted by residents on the basis of mixed contracts (agreements) The codes of operation type of this section and section 23 of the List are used if the transferred amount simultaneously consists of payments for goods and/or services and/or works and/or information and/or results of intellectual activities (including their exclusive rights) on the basis of the following contracts that for the purpose of this Annex are identified as mixed contracts (agreements): а) contracts (agreements) that provide for the export (import) of goods from (to) the territory of the Russian Federation together with performance of works and/or provision of services and/or submission of information and/or results of intellectual activities (including their exclusive rights), including the export (import) of goods for the purpose of recycling or construction of objects abroad or in the Russian Federation; b) contracts (agreements) specified in subsection 5.1.2 of the Instruction; c) capital lease contracts; d) agency contracts (commission contracts, authorisation contracts) that provide for the import (export) of goods from (to) the territory of the Russian Federation. |

| 22 100 | Settlements of non-resident commitents (principals) as prepayments to a resident commissioner (agent, guarantor) for goods to be exported from the territory of the Russian Federation, works to be performed, services to be provided and information and results of intellectual activities (including their exclusive rights) to be submitted (prepayment), except for settlements with code 22110 and settlements related to payment of remuneration to a resident broker on the basis of a brokerage contract (section 58 of the List) |

| 22 110 | Settlements of non-residents as prepayments to a resident for goods to be delivered, works to be performed, services to be provided and information and results of intellectual activities (including their exclusive rights) to be submitted in accordance with the contracts (agreements) stipulated in subsection 5.1.2 of the Instruction (prepayment) |

| 22 200 | Settlements of non-resident commitents (principals) as instalments to a resident commissioner (agent, guarantor) for goods exported from the territory of the Russian Federation, works performed, services provided and information and results of intellectual activities (including their exclusive rights) submitted (instalment), except for settlements with code 22210 and settlements related to payment of remuneration to a resident broker on the basis of a brokerage contract (section 58 of the List) |

| 22 210 | Settlements of non-residents if a resident has granted deferral of payment for goods delivered, works performed, services provided and information and results of intellectual activities (including their exclusive rights) submitted in accordance with the contracts (agreements) stipulated in subsection 5.1.2 of the Instruction (instalment) |

| 22 300 | Settlements of non-residents in favour of a resident on the basis of a capital lease contract |

| 22 800 | Settlements of residents in favour of a non-resident related to returning excess funds received on the basis of |

| mixed contracts (agreements) | |

| 23 | Settlements between residents and non-residents related to goods delivered, works performed, services provided and information and results of intellectual activities (including their exclusive rights) submitted by non-residents on the basis of mixed contracts (agreements) |

| 23 100 | Settlements of resident commitents (principals) as prepayments to a nonresident commissioner (agent, guarantor) for goods to be imported to the territory of the Russian Federation, works to be performed, services to be provided and information and results of intellectual activities (including their exclusive rights) to be submitted (prepayment), except for settlements with code 23110 and settlements related to payment of remuneration to a non-resident broker on the basis of a brokerage contract (section 58 of the List) |

| 23 110 | Settlements of residents as prepayments to a non-resident for goods to be delivered, works to be performed, services to be provided and information and results of intellectual activities (including their exclusive rights) to be submitted in accordance with the contracts (agreements) stipulated in subsection 5.1.2 of the Instruction (prepayment) |

| 23 200 | Settlements of resident commitents (principals) if a non-resident commissioner (agent, guarantor) has granted deferral of payment for goods exported from the territory of the Russian Federation, works performed, services provided and information and results of intellectual activities (including their exclusive rights) submitted (instalment), except for settlements with code 23210 and settlements related to payment of remuneration to a non-resident broker on the basis of a brokerage contract (section 58 of the List) |

| 23 210 | Settlements of non-residents if a resident has granted deferral of payment for goods delivered, works performed, services provided and information and results of intellectual activities (including their exclusive rights) submitted in accordance with the contracts (agreements) stipulated in subsection 5.1.2 of the Instruction (instalment) |

| 23 300 | Settlements of residents in favour of a non-resident on the basis of a capital lease contract |

| 23 900 | Settlements of non-residents in favour of a resident related to returning excess funds received on the basis of mixed contracts (agreements |

| 30 | Settlements between residents and non-residents related to real estate transactions, except for payments for aircrafts, marine and inland vessels and space objects |

| 30 010 | Settlements of non-residents in favour of a resident for real estate purchased outside the territory of the Russian Federation, inter alia in connection with the share of the non-resident in real estate being built by the resident outside the territory of the Russian Federation |

| 30 020 | Settlements of residents in favour of a non-resident for real estate purchased outside the territory of the Russian Federation, inter alia in connection with the share of the resident in real estate being built by the nonresident outside the territory of the Russian Federation |

| 30 030 | Settlements of non-residents in favour of a resident for real estate purchased on the territory of the Russian Federation, inter alia in connection with the share of the non-resident in real estate being built by the resident on the territory of the Russian Federation |

| 30 040 | Settlements of residents in favour of a non-resident for real estate purchased on the territory of the Russian Federation, inter alia in connection with the share of the resident in real estate being built by the non-resident on the territory of the Russian Federation |

| 30 800 | Settlements of residents in favour of a non-resident related to excess funds received on real estate transactions, inter alia in connection with participation in building real estate |

| 30 900 | Settlements of non-residents in favour of a resident related to excess funds received on real estate transactions, inter alia in connection with participation in building real estate |

| 32 | Settlements of residents and non-residents on the basis of agreements on assignment of right of demand and debt transfer agreements concluded between residents and non-residents |

| 32 010 | Settlements of non-residents in favour of a resident for a right of demand assigned by the resident to the nonresident on the basis of an agreement on assignment of right of demand |

| 32 015 | Settlements of residents in favour of a non-resident for a right of demand assigned by the non-resident to the resident on the basis of an agreement on assignment of right of demand |

| 32 020 | Settlements of non-residents in favour of a resident for a debt transferred by the non-resident to the resident on the basis of a debt transfer agreement |

| 32 025 | Settlements of residents in favour of a non-resident for a debt transferred by the resident to the non-resident on the basis of a debt transfer agreement |

| 35 | Settlements of residents and non-residents in other operations related to foreign trade activities and not directly specified in sections 10 to 23 of the List |

| 35 030 | Settlements of non-residents in favour of a resident in other operations related to foreign trade activities and not directly specified in sections 10 to 23 of the List |

| 35 040 | Settlements of residents in favour of a non-resident in other operations related to foreign trade activities and not directly specified in sections 10 to 23 of the List |

| 40 | Settlements in connection with provision of funds to non-residents by residents (except authorised banks) on the basis of loan agreements |

| 40 030 | Settlements of residents in favour of a non-resident in provision of funds on the basis of a loan agreement |

| 40 900 | Settlements of non-residents in favour of a resident in connection with returning excess funds received by the non-resident from the resident on the basis of a loan agreement |

| 41 | Settlements in connection with provision of funds to residents by nonresidents (except authorised banks) on the basis of credit and loan agreements |

| 41 030 | Settlements of non-residents in favour of a resident in provision of funds on the basis of a credit or loan agreement |

| 41 800 | Settlements of residents in favour of a non-resident in connection with returning excess funds received by the resident from the non-resident on the basis of a loan agreement |

| 42 | Settlements in connection to residents (except for authorised banks) meeting obligations arising from monetary credits and loans on the basis of credit and loan agreements |

| 42 015 | Settlements of residents in favour of a non-resident in returning the principal amount of the debt arising from a credit or loan agreement |

| 42 035 | Settlements of residents in favour of a non-resident in returning interest arising from a credit or loan agreement |

| 42 050 | Other settlements of residents in favour of a non-resident in payment of premiums (commissions) and other monetary payments arising from a credit or loan taken |

| 42 900 | Settlements of non-residents in favour of a resident in returning excess funds received from the resident as a payment of principal amount of the debt arising from a credit or loan agreement |

| 42 950 | Settlements of non-residents in favour of a resident in returning the excess interest arising from a credit or loan agreement |

| 43 | Settlements in connection with meeting the obligations of non-residents arising from monetary loans on the basis of loan agreements |

| 43 015 | Settlements of non-residents in favour of a resident in returning the principal amount of the debt arising from a loan agreement |

| 43 035 | Settlements of non-residents in favour of a resident in returning interest arising from a loan agreement |

| 43 050 | Other settlements of non-residents in favour of a resident in payment of premiums (commissions) and other monetary payments arising from a loan taken |

| 43 800 | Settlements of residents in favour of a non-resident in connection with returning excess funds received by the resident from the non-resident in the course of returning the principal of the loan on the basis of a loan agreement |

| 43 850 | Settlements of residents in favour of a non-resident in connection with returning excess funds received by the resident from the non-resident in the course of returning the interest on the loan on the basis of a loan agreement |

| 50 | Settlements in connection with investments in the form of capital formation |

| 50 100 | Settlements of residents in favour of a non-resident arising from transactions with shares, contributions, capital shares in a legal person (authorised share capital or inventory capital, mutual fund) or from a simple partnership agreement |

| 50 110 | Settlements of residents in favour of a non-resident arising from disbursement of dividends (returns) from investments made as capital formation |

| 50 200 | Settlements of non-residents in favour of a resident arising from transactions with shares, contributions, capital shares in a legal person (authorised share capital or inventory capital, mutual fund) or from a simple partnership agreement |

| 50 210 | Settlements of non-residents in favour of a resident arising from disbursement of dividends (returns) from investments made as capital formation |

| 50 800 | Settlements of residents in favour of a non-resident in connection with returning excess funds received on the basis of investment transactions made as capital formation |

| 50 900 | Settlements of non-residents in favour of a resident in connection with returning excess funds received on the basis of investment transactions made as capital formation |

| 51 | Settlements related to the purchase of securities (rights certified by securities) by non-residents from residents, except for settlements with codes defined in section 58 of the List |

| 51 210 | Settlements of non-residents in favour of a resident for obligations, shares and other issued securities of residents |

| 51 215 | Settlements of non-residents in favour of a resident for obligations, shares and other issued securities of nonresidents |

| 51 230 | Settlements of non-residents in favour of a resident for shares of investment funds established by the resident |

| 51 235 | Settlements of non-residents in favour of a resident for shares of investment funds established by the nonresident |

| 51 250 | Settlements of non-residents in favour of a resident for bills of exchange and other securities issued by the resident |

| 51 255 | Settlements of non-residents in favour of a resident for bills of exchange and other securities issued by the nonresident |

| 51 800 | Settlements of residents in favour of a non-resident related to returning excess funds received from transactions with securities (or rights certified by securities) and funds arising from unmet obligations |

| 52 | Settlements related to the purchase of securities (rights certified by securities) by residents from nonresidents, except for settlements with codes defined in section 58 of the List |

| 52 210 | Settlements of residents in favour of a non-resident for obligations, shares and other issued securities of residents |

| 52 215 | Settlements of residents in favour of a non-resident for obligations, shares and other issued securities of nonresidents |

| 52 230 | Settlements of residents in favour of a non-resident for shares of investment funds established by the nonresident |

| 52 235 | Settlements of residents in favour of a non-resident for shares of investment funds established by the resident |

| 52 250 | Settlements of residents in favour of a non-resident for bills of exchange and other securities issued by residents |

| 52 255 | Settlements of residents in favour of a non-resident for bills of exchange and other securities issued by nonresidents |

| 52 900 | Settlements of non-residents in favour of a resident related to returning excess funds received from transactions with securities (or rights certified by securities) and funds arising from unmet obligations |

| 55 | Settlements related to the performance by residents and non-residents of obligations with regard to securities, except for settlements with codes defined in section 58 of the List |

| 55 210 | Settlements of residents in favour of a non-resident in meeting the obligations arising from obligations, shares and other issued securities |

| 55 230 | Settlements of residents in favour of a non-resident in disbursement of returns from mutual funds |

| 55 250 | Settlements of residents in favour of a non-resident in meeting the obligations arising from bills of exchange and other non-negotiable securities |

| 55 310 | Settlements of non-residents in favour of a resident in meeting the obligations arising from obligations, shares and other issued securities |

| 55 330 | Settlements of non-residents in favour of a resident in disbursement of returns from mutual funds |

| 55 350 | Settlements of non-residents in favour of a resident in meeting the obligations arising from bills of exchange and other non-negotiable securities |

| 55 800 | Settlements of residents in favour of a non-resident related to returning excess funds received from securities transactions and funds arising from unmet obligations |

| 55 900 | Settlements of non-residents in favour of a resident related to returning excess funds received from securities transactions and funds arising from unmet obligations |

| 56 | Settlements between residents and non-residents under operations with derivatives and other future transactions |

| 56 010 | Settlements of non-residents in favour of a resident pursuant to transactions with derivatives and futures (premiums, margin and guarantee deposits and other funds transferred in accordance with contract stipulations, except for settlements related to delivery of underlying assets) |

| 56 060 | Settlements of residents in favour of a non-resident pursuant to transactions with derivatives and futures (premiums, margin and guarantee deposits and other funds transferred in accordance with contract stipulations, except for settlements related to delivery of underlying assets) |

| 56 800 | Settlements of residents in favour of a non-resident related to returning excess funds received from securities transactions and funds arising from unmet obligations under this section |

| 56 900 | Settlements of non-residents in favour of a resident related to returning excess funds received from securities transactions and funds arising from unmet obligations under this section |

| 57 | Settlements under contracts of trust control of property |

| 57 010 | Settlements of residents (trustors) in favour of a resident (trust manager who is not an authorised bank) in foreign currency |

| 57 015 | Settlements of residents (trust manager who is not an authorised bank) in favour of a resident (trustor) in foreign currency |

| 57 020 | Settlements of non-residents (trustors) in favour of a resident (trust manager who is not an authorised bank) in the currency of the Russian Federation |

| 57 025 | Settlements of residents (trust manager who is not an authorised bank) in favour of a non-resident (trustor) in the currency of the Russian Federation |

| 57 800 | Settlements of residents related to returning funds received under contracts of trust control of property to a nonresident |

| 57 900 | Settlements of non-residents related to returning excess funds received under contracts of trust control of property to a resident |

| 58 | Settlements under brokerage contracts, except for settlements with codes defined in sections 51 to 55 of the List |

| 58 010 | Settlements of residents (except for authorised banks) in favour of a nonresident on the basis of brokerage contracts, including payment of brokerage fee to a non-resident broker |

| 58 020 | Settlements of non-residents (except for authorised banks) in favour of a resident on the basis of brokerage contracts, including payment of brokerage fee to a resident broker |

| 58 030 | Settlements between residents under brokerage contracts in foreign currency, including payment of brokerage fee |

| 58 700 | Settlements of resident brokers related to returning funds to a resident on the basis of a brokerage contract |

| 58 800 | Settlements of resident brokers (except for authorised banks) related to returning transferred funds to a nonresident on the basis of a brokerage contract |

| 58 900 | Settlements of non-resident brokers related to returning transferred funds to a resident (except for an authorised bank) on the basis of a brokerage contract |

| 60 | Transfers of non-residents, withdrawal (depositing) of currency of the Russian Federation in cash from (to) a Russian currency account of a non-resident |

| 60 070 | Transfers of currency of the Russian Federation from a Russian currency account of a non-resident to another Russian currency account (deposit account) opened for the non-resident in the same authorised bank; from a deposit account in Russian currency of a non-resident to another bank account opened for the non-resident in the same authorised bank |

| 60 071 | Transfers of currency of the Russian Federation from a Russian currency account of a non-resident opened in an authorised bank to another Russian currency account (deposit account) opened for the non-resident in another authorised bank; from a deposit account in Russian currency of a nonresident to another bank account opened for the non-resident in another authorised bank |

| 60 075 | Transfers of currency of the Russian Federation from a Russian currency account of a non-resident opened in an authorised bank to another Russian currency account (deposit account) opened for the non-resident in a nonresident bank; from a deposit account in Russian currency of a non-resident in an authorised bank to a Russian currency bank account opened for the non-resident in a non-resident bank |

| 60 080 | Transfers of currency of the Russian Federation from a Russian currency account of a non-resident to a Russian currency account (deposit account) opened for another non-resident in the same authorised bank |

| 60 081 | Transfers of currency of the Russian Federation from a Russian currency account of a non-resident opened in an authorised bank to a Russian currency account (deposit account) opened for another non-resident in another authorised bank |

| 60 090 | Withdrawal of cash in the currency of the Russian Federation from the Russian currency account of a nonresident in an authorised bank |

| 60 095 | Depositing of cash in the currency of the Russian Federation to the Russian currency account of a non-resident in an authorised bank |

| 61 | Settlements and transfers of residents, withdrawal (depositing) of foreign currency in cash by residents |

| 61 070 | Settlements between residents in foreign currency on the basis of contracts of freight forwarding, contracts of carriage and contracts of affreightment (charters) in the course of providing services of forwarding agent, carrier and charterer in connection with the export of goods from or import of goods to the Russian Federation, transit of goods on the territory of the Russian Federation or insurance agreements on such goods |

| 61 100 | Transfers in foreign currency from the transit currency account of a resident to another transit currency account of the same resident or to a foreign currency account of the same resident |

| 61 115 | Settlements in foreign currency between resident commissioners (agents, solicitors) and resident commitents (principals) in connection with services provided by the commissioners (agents, solicitors) that include concluding and performing agreements with non-residents for delivering goods, performing works, providing services and submitting information and results of intellectual activities (including their exclusive rights), including operations for returning funds to the commitents (principals), except for payments with codes 58030, 58700 and 61162 |

| 61 130 | Transfers in foreign currency from a foreign currency current account of a resident opened in an authorised bank to a foreign currency account of the resident opened in the same authorised bank |

| 61 135 | Transfers in foreign currency from a foreign currency current account of a resident opened in an authorised bank to a foreign currency account of the resident opened in another authorised bank |

| 61 140 | Transfers in foreign currencies or currency of the Russian Federation from an account of a resident opened in a non-resident bank to an account of the resident opened in an authorised bank |

| 61 145 | Transfers in foreign currencies or currency of the Russian Federation from an account of a resident opened in a non-resident bank to an account of another resident opened in an authorised bank |

| 61 150 | Transfers in foreign currencies or currency of the Russian Federation from an account of a resident opened in an authorised bank to an account of the resident opened in a non-resident bank |

| 61 155 | Transfers in foreign currencies or currency of the Russian Federation from an account of a resident opened in an authorised bank to an account of another resident opened in a non-resident bank |

| 61 160 | Settlements between residents in foreign currency in connection to establishment and returning of an individual and/or collective clearing security pursuant to federal law No. 7-FZ of 7 February 2011 “On Clearing and Clearing Activities” (Collection of Legislation of the Russian Federation 2011, No. 7, § 904; No. 48, § 6728; No. 49, § 7040, § 7061) (hereinafter referred to as the federal law “On Clearing and Clearing Activities”) |

| 61 161 | Settlements between residents in foreign currency based on the clearing results pursuant to the federal law “On Clearing and Clearing Activities” |

| 61 162 | Settlements in foreign currency between resident commissioners (agents, solicitors) and resident commitents (principals) in connection with services provided by the commissioners (agents, solicitors) arising from concluding and performing agreements that must be performed in accordance with clearing results pursuant to the federal law “On Clearing and Clearing Activities”, including returning of funds to commitents (principals) |

| 61 163 | Settlements in foreign currency between residents in connection with performance and/or termination of an agreement serving as a financial derivative instrument |

| 61 170 | Withdrawal of cash from a foreign currency bank account of a resident opened in an authorised bank |

| 61 175 | Depositing of cash to a foreign currency bank account of a resident opened in an authorised bank |

| 70 | Non-commercial operations |

| 70 010 | Settlements of non-residents in favour of a resident related to collection of taxes, fees, etc., except for settlements with code 70120 |

| 70 020 | Settlements of residents in favour of a non-resident related to collection of taxes, fees, etc., except for settlements with code 70125 |

| 70 030 | Settlements related to disbursement of pensions, benefits and other social payments from non-residents to a resident, except for settlements with code 70120 |

| 70 040 | Settlements related to disbursement of pensions, benefits and other social payments from residents to a nonresident, except for settlements with code 70125 |

| 70 050 | Settlements related to disbursement of wages and other employment payments from non-residents to a resident, except for settlements with code 70120 |

| 70 060 | Settlements related to disbursement of wages and other employment payments from residents to a nonresident, except for settlements with code 70125 |

| 70 090 | Settlements related to paying non-repayable financial aid by non-residents to a resident, except for settlements with code 70100 |

| 70 095 | Settlements related to paying non-repayable financial aid by residents to a non-resident, except for settlements with code 70105 |

| 70 100 | Settlements related to making charity donations, collecting donations and disbursing (receiving) research grants and other non-repayable payments by non-residents to a resident |

| 70 105 | Settlements related to making charity donations, collecting donations and disbursing (receiving) research grants and other non-repayable payments by residents to a non-resident |

| 70 110 | Settlements of non-residents in favour of a resident related to disbursement of insurance indemnities on the basis of an insurance or reinsurance agreement |

| 70 115 | Settlements of residents in favour of a non-resident related to disbursement of insurance indemnities on the basis of an insurance or reinsurance agreement |

| 70 120 | Settlements of non-residents in favour of a resident related to execution of court decisions |

| 70 125 | Settlements of residents in favour of a non-resident related to execution of court decisions |

| 70 200 | Other settlements of non-residents in favour of a resident related to noncommercial operations, except for settlements with codes 70010, 70030, 70050, 70090, 70100, 70110, 70120 |

| 70 205 | Other settlements of residents in favour of a non-resident related to noncommercial operations, except for settlements with codes 70020, 70040, 70060, 70095, 70105, 70115, 70125 |

| 70 800 | Settlements of residents in favour of non-residents related to returning of excess funds received from noncommercial operations |

| 70 900 | Settlements of non-residents in favour of residents related to returning of excess funds received from noncommercial operations |

| 80 | Settlements between authorised banks and non-residents in the currency of the Russian Federation and between authorised banks and residents in foreign currency Codes of operation types in section80 shall only be used by authorised banks for the purpose of keeping data concerning currency and other operations performed by residents and non-residents. |

| 80 010 | Settlements between non-residents and authorised banks in the currency of the Russian Federation on the basis of loan agreements |

| 80 020 | Debiting of currency of the Russian Federation from a Russian currency account of a non-resident in connection with opening a letter of credit |

| 80 021 | Transfer of currency of the Russian Federation to a Russian currency account of a non-resident in connection with closing a letter of credit |

| 80 050 | Settlements between non-residents and authorised banks in the currency of the Russian Federation in connection with other operations, except for settlements with codes 80010, 80020, 80021 |

| 80 110 | Settlements between residents and authorised banks in foreign currency on the basis of loan agreements |

| 80 120 | Debiting of foreign currency from a current account of a resident opened in an authorised bank in connection with opening a letter of credit |

| 80 121 | Transfer of currency of the Russian Federation to a current account of a resident opened in an authorised bank in connection with closing a letter of credit |

| 80 150 | Settlements between residents and authorised banks in foreign currency in connection with other operations, except for settlements with codes 80110, 80120, 80121 |

| 99 | Settlements related to other operations not directly specified in sections 01 to 80 of the list |

| 99 010 | Return of mistakenly debited (credited) funds to residents |

| 99 020 | Return of mistakenly debited (credited) funds to non-residents |

| 99 090 | Settlements related to operations not specified in sections 01 to 80 of the List, except for payments with codes 99010, 99020 |

Russian – Latin character table

Table for replacing russian characters with latin characters

| Russian character | Latin character SWIFT RUR6 |

|---|---|

| А | A |

| Б | B |

| В | V |

| Г | G |

| Д | D |

| Е | E |

| Ё | o (lower case) |

| Ж | J |

| З | Z |

| И | I |

| Й | i (lower case) |

| К | K |

| Л | L |

| М | M |

| Н | N |

| О | O |

| П | P |

| Р | R |

| С | S |

| Т | T |

| У | U |

| Ф | F |

| Х | H |

| Ц | C |

| Ц | C |

| Ч | c (lower case) |

| Ш | Q |

| Щ | q (lower case) |

| Ъ | x (lower case) |

| Ы | Y |

| Ь | X |

| Э | e (lower case) |

| Ю | u (lower case) |

| Я | a (lower case) |

| ’ | ’ (apostrophe) |

| 0 | 0 |

| 1 | 1 |

| 2 | 2 |

| 3 | 3 |

| 4 | 4 |

| 5 | 5 |

| 6 | 6 |

| 7 | 7 |

| 8 | 8 |

| 9 | 9 |

| ( | ( |

| ) | ) |

| ? | ? |

| + | + |

| , | , |

| / | / |

| - | - (hyphen) |

| . | . (full stop) |

| : | : (colon) |

Words in Latin script that are not translated (e.g. name of beneficiary’s company is registered in Latin script) must be between apostrophes (‘). For example, the transliteration of ФИРМА "XEROX“ would be FIRMA ’XEROX’