You can find the most crisis-resilient funds from our selection

Instead of using broad-based indexes, we prefer to actively manage assets. This means that our pension asset investment decisions are made by our strong team who constantly monitors the surrounding environment, looks for the best investment opportunities, and spreads risk across different asset classes. This makes LHV’s investment portfolios unique in the market.

When choosing a II pillar pension fund, you should take into account:

- How long you have left until retirement and how much you want to risk?

- How have the funds fared in the long term?

Is cheap always the best? No. How effective the fund you choose is at growing your retirement savings depends most on its ability to generate new money. If the rate of return is negative, a low service fee is of little help. Index funds attract with their low management fees because they take less time to manage, but they are no guarantee that your pension fund will be successful.

No. In our view, those born in the same decade do not have the same risk tolerance and risk appetite. Perhaps when you reach the age of 55, you would like to continue saving up in a fund with a higher proportion of equity than the default below 50%? We believe that the best choices are well thought out and must change over time, just as you will change over time.

Yes. Different times create different opportunities, and with active management, decisions are made by experts according to the economic situation – following careful analysis, risks are spread across asset classes such as forest, real estate, raw materials. However, index funds invest all assets in equity indices, and the fund’s performance depends on the performance of equity markets.

Choose the fund that’s right for you

If you want a higher rate of return, you also have to consider a higher risk. As a rule, the more a fund invests in stock markets, the higher the risk level of the fund. As people tolerate risk differently, the choice of fund should be well thought out and meaningful; for example, with a life-cycle fund, you cannot decide how much risk you are willing to take at any given time. You can also split your portfolio between several funds – you decide what works best for you.

High risk level

If you have a high risk tolerance, pension funds with the highest proportion of equities or equity funds may be suitable. Examples include LHV funds XL, Indeks, and Roheline.

Medium risk level

If you feel you would like a slightly lower proportion of equity, take a closer look at the L or M fund.

Low risk level

If your aim is to preserve money, go for the S or XS.

Compare II pillar funds

Fund performance in previous periods does not constitute a promise or indication of the yield of subsequent periods.

Market overview of pension funds

New records in stock markets

Andres Viisemann, Head of LHV Pension Funds

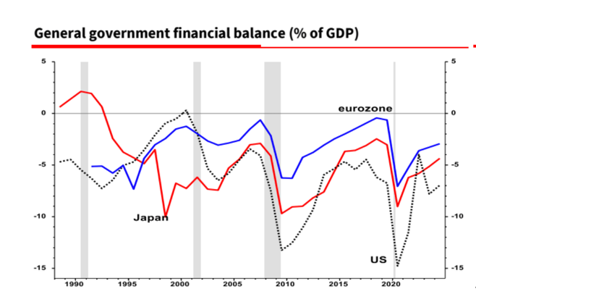

The world’s largest stock markets have continued the upward trend that began last October, undergoing a new period of acceleration and reaching new peaks. In my opinion, however, the biggest event in the global stock markets was the powerful rise of the Nikkei 225 index, which tracks the Japanese stock markets.

Every fourth euro invested helps the Estonian economy grow

Join LHV pensionAsk for advice

Reet Roos

Pension Consultant

Mon–Fri 8–17

680 2743

Sign up for a consultation